Unit Root Testing¶

This setup code is required to run in an IPython notebook

[1]:

import warnings

import matplotlib.pyplot as plt

import seaborn as sns

warnings.simplefilter("ignore")

sns.set_style("darkgrid")

plt.rc("figure", figsize=(16, 6))

plt.rc("savefig", dpi=90)

plt.rc("font", family="sans-serif")

plt.rc("font", size=14)

Setup¶

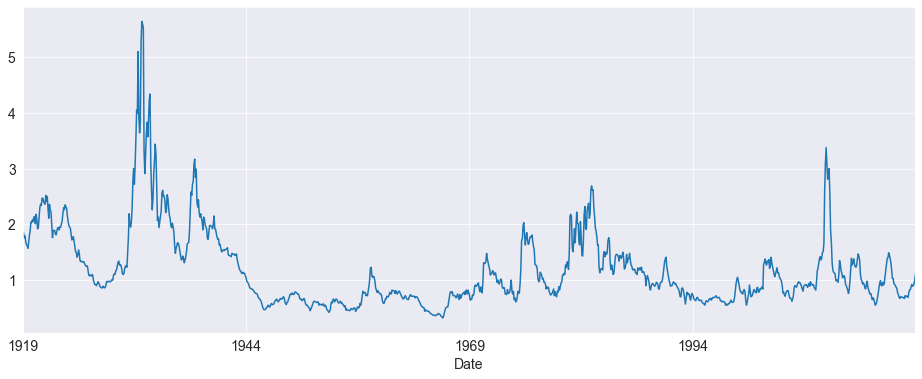

Most examples will make use of the Default premium, which is the difference between the yields of BAA and AAA rated corporate bonds. The data is downloaded from FRED using pandas.

[2]:

import arch.data.default

import pandas as pd

import statsmodels.api as sm

default_data = arch.data.default.load()

default = default_data.BAA.copy()

default.name = "default"

default = default - default_data.AAA.values

fig = default.plot()

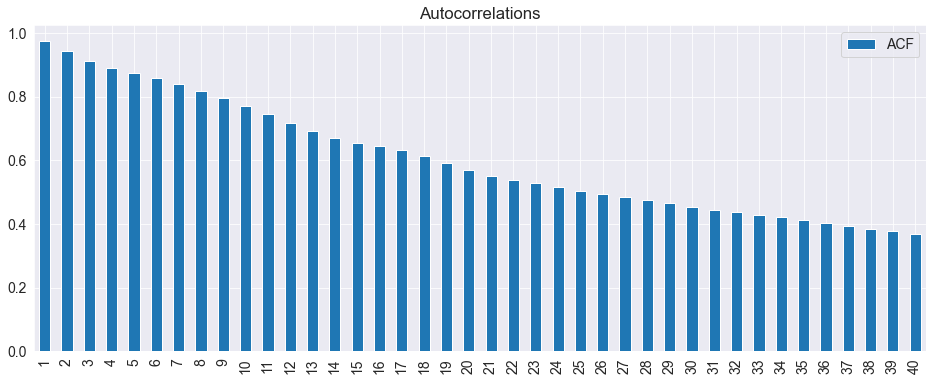

The Default premium is clearly highly persistent. A simple check of the autocorrelations confirms this.

[3]:

acf = pd.DataFrame(sm.tsa.stattools.acf(default), columns=["ACF"])

fig = acf[1:].plot(kind="bar", title="Autocorrelations")

Augmented Dickey-Fuller Testing¶

The Augmented Dickey-Fuller test is the most common unit root test used. It is a regression of the first difference of the variable on its lagged level as well as additional lags of the first difference. The null is that the series contains a unit root, and the (one-sided) alternative is that the series is stationary.

By default, the number of lags is selected by minimizing the AIC across a range of lag lengths (which can be set using max_lag when initializing the model). Additionally, the basic test includes a constant in the ADF regression.

These results indicate that the Default premium is stationary.

[4]:

from arch.unitroot import ADF

adf = ADF(default)

print(adf.summary().as_text())

Augmented Dickey-Fuller Results

=====================================

Test Statistic -3.356

P-value 0.013

Lags 21

-------------------------------------

Trend: Constant

Critical Values: -3.44 (1%), -2.86 (5%), -2.57 (10%)

Null Hypothesis: The process contains a unit root.

Alternative Hypothesis: The process is weakly stationary.

The number of lags can be directly set using lags. Changing the number of lags makes no difference to the conclusion.

Note: The ADF assumes residuals are white noise, and that the number of lags is sufficient to pick up any dependence in the data.

Setting the number of lags¶

[5]:

adf = ADF(default, lags=5)

print(adf.summary().as_text())

Augmented Dickey-Fuller Results

=====================================

Test Statistic -3.582

P-value 0.006

Lags 5

-------------------------------------

Trend: Constant

Critical Values: -3.44 (1%), -2.86 (5%), -2.57 (10%)

Null Hypothesis: The process contains a unit root.

Alternative Hypothesis: The process is weakly stationary.

Deterministic terms¶

The deterministic terms can be altered using trend. The options are:

'nc': No deterministic terms'c': Constant only'ct': Constant and time trend'ctt': Constant, time trend and time-trend squared

Changing the type of constant also makes no difference for this data.

[6]:

adf = ADF(default, trend="ct", lags=5)

print(adf.summary().as_text())

Augmented Dickey-Fuller Results

=====================================

Test Statistic -3.786

P-value 0.017

Lags 5

-------------------------------------

Trend: Constant and Linear Time Trend

Critical Values: -3.97 (1%), -3.41 (5%), -3.13 (10%)

Null Hypothesis: The process contains a unit root.

Alternative Hypothesis: The process is weakly stationary.

Regression output¶

The ADF uses a standard regression when computing results. These can be accesses using regression.

[7]:

reg_res = adf.regression

print(reg_res.summary().as_text())

OLS Regression Results

==============================================================================

Dep. Variable: y R-squared: 0.095

Model: OLS Adj. R-squared: 0.090

Method: Least Squares F-statistic: 17.83

Date: Mon, 24 Nov 2025 Prob (F-statistic): 1.30e-22

Time: 04:21:07 Log-Likelihood: 630.15

No. Observations: 1194 AIC: -1244.

Df Residuals: 1186 BIC: -1204.

Df Model: 7

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Level.L1 -0.0248 0.007 -3.786 0.000 -0.038 -0.012

Diff.L1 0.2229 0.029 7.669 0.000 0.166 0.280

Diff.L2 -0.0525 0.030 -1.769 0.077 -0.111 0.006

Diff.L3 -0.1363 0.029 -4.642 0.000 -0.194 -0.079

Diff.L4 -0.0510 0.030 -1.727 0.084 -0.109 0.007

Diff.L5 0.0440 0.029 1.516 0.130 -0.013 0.101

const 0.0383 0.013 2.858 0.004 0.012 0.065

trend -1.586e-05 1.29e-05 -1.230 0.219 -4.11e-05 9.43e-06

==============================================================================

Omnibus: 665.553 Durbin-Watson: 2.000

Prob(Omnibus): 0.000 Jarque-Bera (JB): 146083.295

Skew: -1.425 Prob(JB): 0.00

Kurtosis: 57.113 Cond. No. 5.70e+03

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 5.7e+03. This might indicate that there are

strong multicollinearity or other numerical problems.

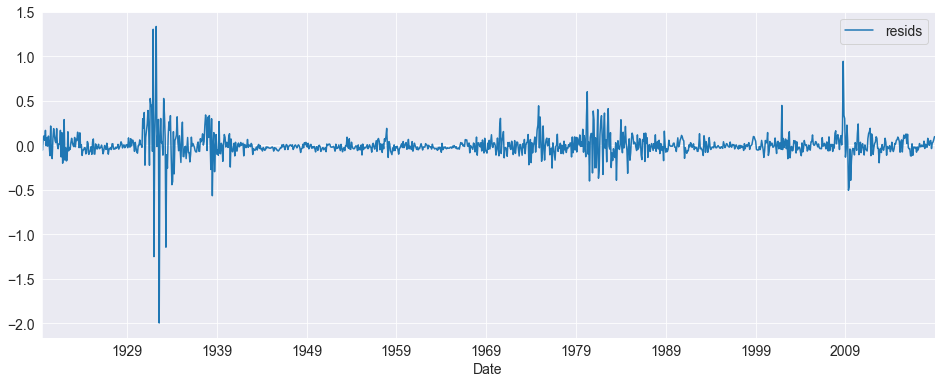

[8]:

import matplotlib.pyplot as plt

import pandas as pd

resids = pd.DataFrame(reg_res.resid)

resids.index = default.index[6:]

resids.columns = pd.Index(["resids"])

fig = resids.plot()

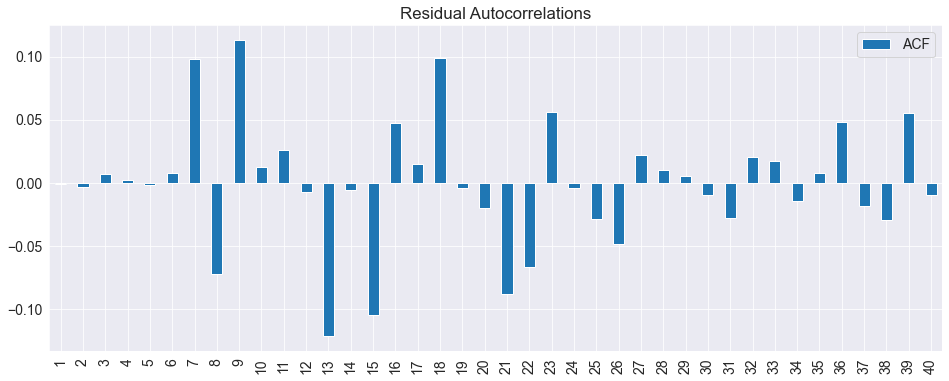

Since the number lags was directly set, it is good to check whether the residuals appear to be white noise.

[9]:

acf = pd.DataFrame(sm.tsa.stattools.acf(reg_res.resid), columns=["ACF"])

fig = acf[1:].plot(kind="bar", title="Residual Autocorrelations")

Dickey-Fuller GLS Testing¶

The Dickey-Fuller GLS test is an improved version of the ADF which uses a GLS-detrending regression before running an ADF regression with no additional deterministic terms. This test is only available with a constant or constant and time trend (trend='c' or trend='ct').

The results of this test agree with the ADF results.

[10]:

from arch.unitroot import DFGLS

dfgls = DFGLS(default)

print(dfgls.summary().as_text())

Dickey-Fuller GLS Results

=====================================

Test Statistic -2.322

P-value 0.020

Lags 21

-------------------------------------

Trend: Constant

Critical Values: -2.59 (1%), -1.96 (5%), -1.64 (10%)

Null Hypothesis: The process contains a unit root.

Alternative Hypothesis: The process is weakly stationary.

The trend can be altered using trend. The conclusion is the same.

[11]:

dfgls = DFGLS(default, trend="ct")

print(dfgls.summary().as_text())

Dickey-Fuller GLS Results

=====================================

Test Statistic -3.464

P-value 0.009

Lags 21

-------------------------------------

Trend: Constant and Linear Time Trend

Critical Values: -3.43 (1%), -2.86 (5%), -2.58 (10%)

Null Hypothesis: The process contains a unit root.

Alternative Hypothesis: The process is weakly stationary.

Phillips-Perron Testing¶

The Phillips-Perron test is similar to the ADF except that the regression run does not include lagged values of the first differences. Instead, the PP test fixed the t-statistic using a long run variance estimation, implemented using a Newey-West covariance estimator.

By default, the number of lags is automatically set, although this can be overridden using lags.

[12]:

from arch.unitroot import PhillipsPerron

pp = PhillipsPerron(default)

print(pp.summary().as_text())

Phillips-Perron Test (Z-tau)

=====================================

Test Statistic -3.898

P-value 0.002

Lags 23

-------------------------------------

Trend: Constant

Critical Values: -3.44 (1%), -2.86 (5%), -2.57 (10%)

Null Hypothesis: The process contains a unit root.

Alternative Hypothesis: The process is weakly stationary.

It is important that the number of lags is sufficient to pick up any dependence in the data.

[13]:

pp = PhillipsPerron(default, lags=12)

print(pp.summary().as_text())

Phillips-Perron Test (Z-tau)

=====================================

Test Statistic -4.024

P-value 0.001

Lags 12

-------------------------------------

Trend: Constant

Critical Values: -3.44 (1%), -2.86 (5%), -2.57 (10%)

Null Hypothesis: The process contains a unit root.

Alternative Hypothesis: The process is weakly stationary.

The trend can be changed as well.

[14]:

pp = PhillipsPerron(default, trend="ct", lags=12)

print(pp.summary().as_text())

Phillips-Perron Test (Z-tau)

=====================================

Test Statistic -4.262

P-value 0.004

Lags 12

-------------------------------------

Trend: Constant and Linear Time Trend

Critical Values: -3.97 (1%), -3.41 (5%), -3.13 (10%)

Null Hypothesis: The process contains a unit root.

Alternative Hypothesis: The process is weakly stationary.

Finally, the PP testing framework includes two types of tests. One which uses an ADF-type regression of the first difference on the level, the other which regresses the level on the level. The default is the tau test, which is similar to an ADF regression, although this can be changed using test_type='rho'.

[15]:

pp = PhillipsPerron(default, test_type="rho", trend="ct", lags=12)

print(pp.summary().as_text())

Phillips-Perron Test (Z-rho)

=====================================

Test Statistic -36.114

P-value 0.002

Lags 12

-------------------------------------

Trend: Constant and Linear Time Trend

Critical Values: -29.16 (1%), -21.60 (5%), -18.17 (10%)

Null Hypothesis: The process contains a unit root.

Alternative Hypothesis: The process is weakly stationary.

KPSS Testing¶

The KPSS test differs from the three previous in that the null is a stationary process and the alternative is a unit root.

Note that here the null is rejected which indicates that the series might be a unit root.

[16]:

from arch.unitroot import KPSS

kpss = KPSS(default)

print(kpss.summary().as_text())

KPSS Stationarity Test Results

=====================================

Test Statistic 1.088

P-value 0.002

Lags 20

-------------------------------------

Trend: Constant

Critical Values: 0.74 (1%), 0.46 (5%), 0.35 (10%)

Null Hypothesis: The process is weakly stationary.

Alternative Hypothesis: The process contains a unit root.

Changing the trend does not alter the conclusion.

[17]:

kpss = KPSS(default, trend="ct")

print(kpss.summary().as_text())

KPSS Stationarity Test Results

=====================================

Test Statistic 0.393

P-value 0.000

Lags 20

-------------------------------------

Trend: Constant and Linear Time Trend

Critical Values: 0.22 (1%), 0.15 (5%), 0.12 (10%)

Null Hypothesis: The process is weakly stationary.

Alternative Hypothesis: The process contains a unit root.

Zivot-Andrews Test¶

The Zivot-Andrews test allows the possibility of a single structural break in the series. Here we test the default using the test.

[18]:

from arch.unitroot import ZivotAndrews

za = ZivotAndrews(default)

print(za.summary().as_text())

Zivot-Andrews Results

=====================================

Test Statistic -4.900

P-value 0.040

Lags 21

-------------------------------------

Trend: Constant

Critical Values: -5.28 (1%), -4.81 (5%), -4.57 (10%)

Null Hypothesis: The process contains a unit root with a single structural break.

Alternative Hypothesis: The process is trend and break stationary.

Variance Ratio Testing¶

Variance ratio tests are not usually used as unit root tests, and are instead used for testing whether a financial return series is a pure random walk versus having some predictability. This example uses the excess return on the market from Ken French’s data.

[19]:

import arch.data.frenchdata

import pandas as pd

ff = arch.data.frenchdata.load()

excess_market = ff.iloc[:, 0] # Excess Market

print(ff.describe())

Mkt-RF SMB HML RF

count 1109.000000 1109.000000 1109.000000 1109.000000

mean 0.659946 0.206555 0.368864 0.274220

std 5.327524 3.191132 3.482352 0.253377

min -29.130000 -16.870000 -13.280000 -0.060000

25% -1.970000 -1.560000 -1.320000 0.030000

50% 1.020000 0.070000 0.140000 0.230000

75% 3.610000 1.730000 1.740000 0.430000

max 38.850000 36.700000 35.460000 1.350000

The variance ratio compares the variance of a 1-period return to that of a multi-period return. The comparison length has to be set when initializing the test.

This example compares 1-month to 12-month returns, and the null that the series is a pure random walk is rejected. Negative values indicate some positive autocorrelation in the returns (momentum).

[20]:

from arch.unitroot import VarianceRatio

vr = VarianceRatio(excess_market, 12)

print(vr.summary().as_text())

Variance-Ratio Test Results

=====================================

Test Statistic -5.029

P-value 0.000

Lags 12

-------------------------------------

Computed with overlapping blocks (de-biased)

By default the VR test uses all overlapping blocks to estimate the variance of the long period’s return. This can be changed by setting overlap=False. This lowers the power but does not change the conclusion.

[21]:

warnings.simplefilter("always") # Restore warnings

vr = VarianceRatio(excess_market, 12, overlap=False)

print(vr.summary().as_text())

Variance-Ratio Test Results

=====================================

Test Statistic -6.206

P-value 0.000

Lags 12

-------------------------------------

Computed with non-overlapping blocks

/home/runner/work/arch/arch/arch/unitroot/unitroot.py:549: InvalidLengthWarning:

The length of y is not an exact multiple of 12, and so the final

4 observations have been dropped.

self._compute_statistic()

Note: The warning is intentional. It appears here since when it is not possible to use all data since the data length is not an integer multiple of the long period when using non-overlapping blocks. There is little reason to use overlap=False.