Bootstrap Examples¶

This setup code is required to run in an IPython notebook

[1]:

import warnings

warnings.simplefilter('ignore')

%matplotlib inline

import matplotlib.pyplot as plt

import seaborn

seaborn.set_style('darkgrid')

plt.rc("figure", figsize=(16, 6))

plt.rc("savefig", dpi=90)

plt.rc("font",family="sans-serif")

plt.rc("font",size=14)

Sharpe Ratio¶

The Sharpe Ratio is an important measure of return per unit of risk. The example shows how to estimate the variance of the Sharpe Ratio and how to construct confidence intervals for the Sharpe Ratio using a long series of U.S. equity data.

[2]:

import numpy as np

import pandas as pd

import arch.data.frenchdata

ff = arch.data.frenchdata.load()

The data set contains the Fama-French factors, including the excess market return.

[3]:

excess_market = ff.iloc[:, 0]

print(ff.describe())

Mkt-RF SMB HML RF

count 1109.000000 1109.000000 1109.000000 1109.000000

mean 0.659946 0.206555 0.368864 0.274220

std 5.327524 3.191132 3.482352 0.253377

min -29.130000 -16.870000 -13.280000 -0.060000

25% -1.970000 -1.560000 -1.320000 0.030000

50% 1.020000 0.070000 0.140000 0.230000

75% 3.610000 1.730000 1.740000 0.430000

max 38.850000 36.700000 35.460000 1.350000

The next step is to construct a function that computes the Sharpe Ratio. This function also return the annualized mean and annualized standard deviation which will allow the covariance matrix of these parameters to be estimated using the bootstrap.

[4]:

def sharpe_ratio(x):

mu, sigma = 12 * x.mean(), np.sqrt(12 * x.var())

values = np.array([mu, sigma, mu / sigma]).squeeze()

index = ['mu', 'sigma', 'SR']

return pd.Series(values, index=index)

The function can be called directly on the data to show full sample estimates.

[5]:

params = sharpe_ratio(excess_market)

params

[5]:

mu 7.919351

sigma 18.455084

SR 0.429115

dtype: float64

Reproducibility¶

All bootstraps accept the keyword argument random_state which can contain a NumPy RandomState instance. This allows the same pseudo random values to be used across multiple runs.

Warning¶

The bootstrap chosen must be appropriate for the data. Squared returns are serially correlated, and so a time-series bootstrap is required.

Bootstraps are initialized with any bootstrap specific parameters and the data to be used in the bootstrap. Here the 12 is the average window length in the Stationary Bootstrap, and the next input is the data to be bootstrapped.

[6]:

from arch.bootstrap import StationaryBootstrap

# Initialize with entropy from random.org

entropy = [877788388, 418255226, 989657335, 69307515]

rs = np.random.RandomState(entropy)

bs = StationaryBootstrap(12, excess_market, random_state=rs)

results = bs.apply(sharpe_ratio, 2500)

SR = pd.DataFrame(results[:, -1:], columns=['SR'])

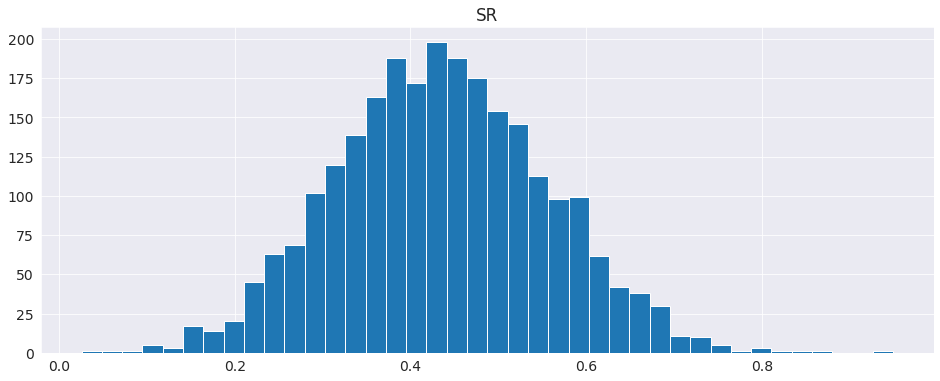

fig = SR.hist(bins=40)

[7]:

cov = bs.cov(sharpe_ratio, 1000)

cov = pd.DataFrame(cov, index=params.index, columns=params.index)

print(cov)

se = pd.Series(np.sqrt(np.diag(cov)), index=params.index)

se.name = 'Std Errors'

print('\n')

print(se)

mu sigma SR

mu 3.835234 -0.700250 0.222532

sigma -0.700250 3.517844 -0.119008

SR 0.222532 -0.119008 0.014912

mu 1.958375

sigma 1.875592

SR 0.122114

Name: Std Errors, dtype: float64

[8]:

ci = bs.conf_int(sharpe_ratio, 1000, method='basic')

ci = pd.DataFrame(ci, index=['Lower', 'Upper'], columns=params.index)

print(ci)

mu sigma SR

Lower 4.319805 14.559092 0.186293

Upper 12.004185 21.517835 0.660455

Alternative confidence intervals can be computed using a variety of methods. Setting reuse=True allows the previous bootstrap results to be used when constructing confidence intervals using alternative methods.

[9]:

ci = bs.conf_int(sharpe_ratio, 1000, method='percentile', reuse=True)

ci = pd.DataFrame(ci, index=['Lower', 'Upper'], columns=params.index)

print(ci)

mu sigma SR

Lower 3.834517 15.392333 0.197774

Upper 11.518896 22.351076 0.671937

Optimal Block Length Estimation¶

The function optimal_block_length can be used to estimate the optimal block lengths for the Stationary and Circular bootstraps. Here we use the squared market return since the Sharpe ratio depends on the mean and the variance, and the autocorrelation in the squares is stronger than in the returns.

[10]:

from arch.bootstrap import optimal_block_length

opt = optimal_block_length(excess_market ** 2)

print(opt)

stationary circular

Mkt-RF 47.766787 54.679322

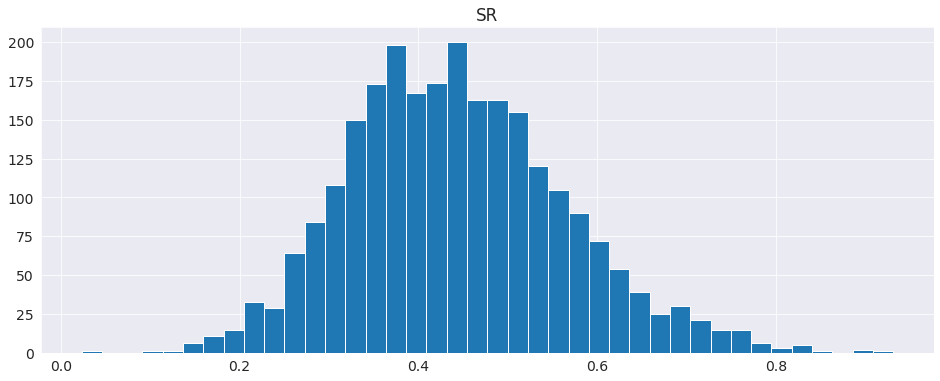

We can repeat the analysis above using the estimated optimal block length. Here we see that the extremes appear to be slightly more extreme.

[11]:

# Reinitialize using the same entropy

rs = np.random.RandomState(entropy)

bs = StationaryBootstrap(opt.loc["Mkt-RF", "stationary"], excess_market, random_state=rs)

results = bs.apply(sharpe_ratio, 2500)

SR = pd.DataFrame(results[:, -1:], columns=['SR'])

fig = SR.hist(bins=40)

Probit (statsmodels)¶

The second example makes use of a Probit model from statsmodels. The demo data is university admissions data which contains a binary variable for being admitted, GRE score, GPA score and quartile rank. This data is downloaded from the internet and imported using pandas.

[12]:

import arch.data.binary

binary = arch.data.binary.load()

binary = binary.dropna()

print(binary.describe())

admit gre gpa rank

count 400.000000 400.000000 400.000000 400.00000

mean 0.317500 587.700000 3.389900 2.48500

std 0.466087 115.516536 0.380567 0.94446

min 0.000000 220.000000 2.260000 1.00000

25% 0.000000 520.000000 3.130000 2.00000

50% 0.000000 580.000000 3.395000 2.00000

75% 1.000000 660.000000 3.670000 3.00000

max 1.000000 800.000000 4.000000 4.00000

Fitting the model directly¶

The first steps are to build the regressor and the dependent variable arrays. Then, using these arrays, the model can be estimated by calling fit

[13]:

import statsmodels.api as sm

endog = binary[['admit']]

exog = binary[['gre', 'gpa']]

const = pd.Series(np.ones(exog.shape[0]), index=endog.index)

const.name = 'Const'

exog = pd.DataFrame([const, exog.gre, exog.gpa]).T

# Estimate the model

mod = sm.Probit(endog, exog)

fit = mod.fit(disp=0)

params = fit.params

print(params)

Const -3.003536

gre 0.001643

gpa 0.454575

dtype: float64

The wrapper function¶

Most models in statsmodels are implemented as classes, require an explicit call to fit and return a class containing parameter estimates and other quantities. These classes cannot be directly used with the bootstrap methods. However, a simple wrapper can be written that takes the data as the only inputs and returns parameters estimated using a Statsmodel model.

[14]:

def probit_wrap(endog, exog):

return sm.Probit(endog, exog).fit(disp=0).params

A call to this function should return the same parameter values.

[15]:

probit_wrap(endog, exog)

[15]:

Const -3.003536

gre 0.001643

gpa 0.454575

dtype: float64

The wrapper can be directly used to estimate the parameter covariance or to construct confidence intervals.

[16]:

from arch.bootstrap import IIDBootstrap

bs = IIDBootstrap(endog=endog, exog=exog)

cov = bs.cov(probit_wrap, 1000)

cov = pd.DataFrame(cov, index=exog.columns, columns=exog.columns)

print(cov)

Const gre gpa

Const 0.384854 -5.813301e-05 -0.101077

gre -0.000058 4.244940e-07 -0.000057

gpa -0.101077 -5.701083e-05 0.039506

[17]:

se = pd.Series(np.sqrt(np.diag(cov)), index=exog.columns)

print(se)

print('T-stats')

print(params / se)

Const 0.620366

gre 0.000652

gpa 0.198760

dtype: float64

T-stats

Const -4.841552

gre 2.521038

gpa 2.287054

dtype: float64

[18]:

ci = bs.conf_int(probit_wrap, 1000, method='basic')

ci = pd.DataFrame(ci, index=['Lower', 'Upper'], columns=exog.columns)

print(ci)

Const gre gpa

Lower -4.194772 0.000354 0.020491

Upper -1.582297 0.002943 0.825360

Speeding things up¶

Starting values can be provided to fit which can save time finding starting values. Since the bootstrap parameter estimates should be close to the original sample estimates, the full sample estimated parameters are reasonable starting values. These can be passed using the extra_kwargs dictionary to a modified wrapper that will accept a keyword argument containing starting values.

[19]:

def probit_wrap_start_params(endog, exog, start_params=None):

return sm.Probit(endog, exog).fit(start_params=start_params, disp=0).params

[20]:

bs.reset() # Reset to original state for comparability

cov = bs.cov(

probit_wrap_start_params,

1000,

extra_kwargs={'start_params': params.values})

cov = pd.DataFrame(cov, index=exog.columns, columns=exog.columns)

print(cov)

Const gre gpa

Const 0.384854 -5.813301e-05 -0.101077

gre -0.000058 4.244940e-07 -0.000057

gpa -0.101077 -5.701083e-05 0.039506

Bootstrapping Uneven Length Samples¶

Independent samples of uneven length are common in experiment settings, e.g., A/B testing of a website. The IIDBootstrap allows for arbitrary dependence within an observation index and so cannot be naturally applied to these data sets. The IndependentSamplesBootstrap allows datasets with variables of different lengths to be sampled by exploiting the independence of the values to separately bootstrap each component. Below is an example showing how a confidence interval can be constructed for the difference in means of two groups.

[ ]:

from arch.bootstrap import IndependentSamplesBootstrap

def mean_diff(x, y):

return x.mean() - y.mean()

rs = np.random.RandomState(0)

treatment = 0.2 + rs.standard_normal(200)

control = rs.standard_normal(800)

bs = IndependentSamplesBootstrap(treatment, control, random_state=rs)

print(bs.conf_int(mean_diff, method='studentized'))