Examples¶

General Setup¶

Models include factors and returns. Factors can be traded or non-traded. Common examples of traded assets include the excess return on the market and the size and value factors. Examples of non-traded assets include macroeconomic shocks and measures of uncertainty.

Models are tested using a set of test portfolios. Test portfolios are often excess returns although they do not need to be.

Import data¶

The data used comes from Ken French”s website and includes 4 factor returns, the excess market, the size factor, the value factor and the momentum factor. The available test portfolios include the 12 industry portfolios, a subset of the size-value two way sort, and a subset of the size-momentum two way sort.

[1]:

from linearmodels.datasets import french

data = french.load()

print(french.DESCR)

Data from Ken French's data library

http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html

dates Year and Month of Return

MktRF Market Factor

SMB Size Factor

HML Value Factor

Mom Momentum Factor

RF Risk-free rate

NoDur Industry: Non-durables

Durbl Industry: Durables

Manuf Industry: Manufacturing

Enrgy Industry: Energy

Chems Industry: Chemicals

BusEq Industry: Business Equipment

Telcm Industry: Telecoms

Utils Industry: Utilities

Shops Industry: Retail

Hlth Industry: Health care

Money Industry: Finance

Other Industry: Other

S1V1 Small firms, low value

S1V3 Small firms, medium value

S1V5 Small firms, high value

S3V1 Size 3, value 1

S3V3 Size 3, value 3

S3V5 Size 3, value 5

S5V1 Large firms, Low value

S5V3 Large firms, medium value

S5V5 Large Firms, High value

S1M1 Small firms, losers

S1M3 Small firms, neutral

S1M5 Small firms, winners

S3M1 Size 3, momentum 1

S3M3 Size 3, momentum 3

S3M5 Size 3, momentum 5

S5M1 Large firms, losers

S5M3 Large firms, neutral

S5M5 Large firms, winners

Transform the portfolios to be excesses¶

Subtract the risk-free rate from the test portfolios since these are not zero-investment.

[2]:

data.iloc[:, 6:] = data.iloc[:, 6:].values - data[["RF"]].values

1-Step Estimation using Seemingly Unrelated Regression (SUR)¶

When the factors are traded assets, they must price themselves, and so the observed factor returns can be used to consistently estimate the expected factor returns. This also allows a set of seemingly unrelated regressions where each test portfolio is regressed on the factors and a constant to estimate factor loadings and \(\alpha\)s.

Note that when using this type of model, it is essential that the test portfolios are excess returns. This is not a requirement of the other factor model estimators.

This specification is a CAP-M since only the market is included. The J-statistic tests whether all model \(\alpha\)s are 0. The CAP-M is unsurprisingly unable to price the test portfolios.

[3]:

from linearmodels.asset_pricing import TradedFactorModel

portfolios = data[

["S1V1", "S1V3", "S1V5", "S3V1", "S3V3", "S3V5", "S5V1", "S5V3", "S5V5"]

]

factors = data[["MktRF"]]

mod = TradedFactorModel(portfolios, factors)

res = mod.fit()

print(res)

TradedFactorModel Estimation Summary

================================================================================

No. Test Portfolios: 9 R-squared: 0.6910

No. Factors: 1 J-statistic: 70.034

No. Observations: 819 P-value 0.0000

Date: Tue, Oct 21 2025 Distribution: chi2(9)

Time: 13:37:36

Cov. Estimator: robust

Risk Premia Estimates

==============================================================================

Parameter Std. Err. T-stat P-value Lower CI Upper CI

------------------------------------------------------------------------------

MktRF 0.0065 0.0015 4.3553 0.0000 0.0035 0.0094

==============================================================================

Covariance estimator:

HeteroskedasticCovariance

See full_summary for complete results

The factor set is expanded to include both the size and the value factors.

While the extra factors lower the J statistic and increases the \(R^2\), the model is still easily rejected.

[4]:

factors = data[["MktRF", "SMB", "HML"]]

mod = TradedFactorModel(portfolios, factors)

res = mod.fit()

print(res)

TradedFactorModel Estimation Summary

================================================================================

No. Test Portfolios: 9 R-squared: 0.8971

No. Factors: 3 J-statistic: 53.271

No. Observations: 819 P-value 0.0000

Date: Tue, Oct 21 2025 Distribution: chi2(9)

Time: 13:37:36

Cov. Estimator: robust

Risk Premia Estimates

==============================================================================

Parameter Std. Err. T-stat P-value Lower CI Upper CI

------------------------------------------------------------------------------

MktRF 0.0065 0.0015 4.3553 0.0000 0.0035 0.0094

SMB 0.0016 0.0010 1.6021 0.1091 -0.0004 0.0035

HML 0.0035 0.0009 3.6993 0.0002 0.0016 0.0053

==============================================================================

Covariance estimator:

HeteroskedasticCovariance

See full_summary for complete results

Changing the test portfolios to include only the industry portfolios does not allow factors to price the assets.

[5]:

indu = [

"NoDur",

"Durbl",

"Manuf",

"Enrgy",

"Chems",

"BusEq",

"Telcm",

"Utils",

"Shops",

"Hlth",

"Money",

"Other",

]

portfolios = data[indu]

mod = TradedFactorModel(portfolios, factors)

res = mod.fit()

print(res)

TradedFactorModel Estimation Summary

================================================================================

No. Test Portfolios: 12 R-squared: 0.7118

No. Factors: 3 J-statistic: 61.617

No. Observations: 819 P-value 0.0000

Date: Tue, Oct 21 2025 Distribution: chi2(12)

Time: 13:37:36

Cov. Estimator: robust

Risk Premia Estimates

==============================================================================

Parameter Std. Err. T-stat P-value Lower CI Upper CI

------------------------------------------------------------------------------

MktRF 0.0065 0.0015 4.3553 0.0000 0.0035 0.0094

SMB 0.0016 0.0010 1.6021 0.1091 -0.0004 0.0035

HML 0.0035 0.0009 3.6993 0.0002 0.0016 0.0053

==============================================================================

Covariance estimator:

HeteroskedasticCovariance

See full_summary for complete results

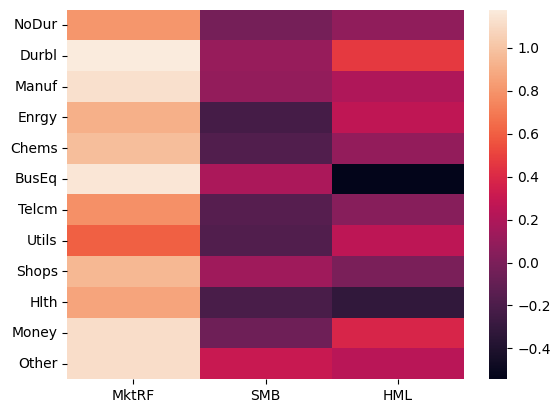

The estimated factor loadings (\(\beta\)s) can be displayed using the betas property. There is reasonable dispersion in the factor loadings for all of the factors, except possibly the market which are all close to unity.

[6]:

print(res.betas)

MktRF SMB HML

NoDur 0.803334 -0.029383 0.080556

Durbl 1.176659 0.104124 0.466510

Manuf 1.129601 0.094600 0.197135

Enrgy 0.913425 -0.234012 0.264609

Chems 0.970844 -0.179466 0.092021

BusEq 1.152119 0.182299 -0.543462

Telcm 0.782811 -0.158395 0.044042

Utils 0.605203 -0.175549 0.260051

Shops 0.942997 0.135802 -0.010064

Hlth 0.864135 -0.213336 -0.315180

Money 1.112368 -0.053364 0.378365

Other 1.109851 0.304442 0.237830

[7]:

import seaborn as sns

%matplotlib inline

sns.heatmap(res.betas)

[7]:

<Axes: >

Similarly the \(\alpha\)s can be displayed. These are monthly returns, and so scaling by 12 shows annualized returns. Healthcare has the largest pricing error.

[8]:

12 * res.alphas

[8]:

NoDur 0.023360

Durbl -0.030919

Manuf -0.010643

Enrgy 0.012009

Chems 0.002783

BusEq 0.024215

Telcm 0.009726

Utils 0.017078

Shops 0.009952

Hlth 0.050760

Money -0.015197

Other -0.033345

Name: alpha, dtype: float64

2-Step Estimation¶

When one of more factors are not returns on traded assets, it is necessary to use a two-step procedure (or GMM). In the 2-step estimator, the first estimates factor loadings and the second uses the factor loadings to estimate the risk premia.

Here all four factors are used to attempt to price the size-momentum portfolios.

[9]:

from linearmodels.asset_pricing import LinearFactorModel

factors = data[["MktRF", "SMB", "HML", "Mom"]]

portfolios = data[

["S1M1", "S1M3", "S1M5", "S3M1", "S3M3", "S3M5", "S5M1", "S5M3", "S5M5"]

]

mod = LinearFactorModel(portfolios, factors)

res = mod.fit()

print(res)

LinearFactorModel Estimation Summary

================================================================================

No. Test Portfolios: 9 R-squared: 0.9051

No. Factors: 4 J-statistic: 36.929

No. Observations: 819 P-value 0.0000

Date: Tue, Oct 21 2025 Distribution: chi2(5)

Time: 13:37:39

Cov. Estimator: robust

Risk Premia Estimates

==============================================================================

Parameter Std. Err. T-stat P-value Lower CI Upper CI

------------------------------------------------------------------------------

MktRF 0.0070 0.0015 4.5385 0.0000 0.0040 0.0100

SMB 0.0005 0.0014 0.3381 0.7353 -0.0023 0.0033

HML 0.0084 0.0025 3.3085 0.0009 0.0034 0.0133

Mom 0.0084 0.0014 5.8072 0.0000 0.0056 0.0112

==============================================================================

Covariance estimator:

HeteroskedasticCovariance

See full_summary for complete results

[10]:

print(res.betas)

MktRF SMB HML Mom

S1M1 1.092658 1.224223 0.244844 -0.691191

S1M3 0.874285 0.881880 0.459326 -0.082546

S1M5 1.047256 1.147949 0.239957 0.297941

S3M1 1.156849 0.623684 0.059730 -0.760059

S3M3 0.948556 0.467783 0.333619 -0.135465

S3M5 1.128861 0.713403 0.051098 0.413705

S5M1 1.138597 -0.112936 -0.062397 -0.755032

S5M3 0.946214 -0.200052 0.095270 -0.100067

S5M5 1.078098 -0.046531 -0.069780 0.467172

The identification requirements for this model are the the \(\beta\)s have unique variation – this requires some cross-sectional differences in exposures and that the loadings are not excessively correlated. Since these test portfolios do not attempt to sort on value, it is relatively non-dispersed and also correlated with both the market and size. This might make the inference unreliable.

[11]:

print(res.betas.corr())

MktRF SMB HML Mom

MktRF 1.000000 -0.001914 -0.733916 -0.253675

SMB -0.001914 1.000000 0.638056 -0.015628

HML -0.733916 0.638056 1.000000 0.002744

Mom -0.253675 -0.015628 0.002744 1.000000

The size factor was insignificant and so is dropped. This does not have much of an effect on the estimates.

[12]:

from linearmodels.asset_pricing import LinearFactorModel

factors = data[["MktRF", "HML", "Mom"]]

portfolios = data[

["S1M1", "S1M3", "S1M5", "S3M1", "S3M3", "S3M5", "S5M1", "S5M3", "S5M5"]

]

mod = LinearFactorModel(portfolios, factors)

print(mod.fit())

LinearFactorModel Estimation Summary

================================================================================

No. Test Portfolios: 9 R-squared: 0.7915

No. Factors: 3 J-statistic: 36.406

No. Observations: 819 P-value 0.0000

Date: Tue, Oct 21 2025 Distribution: chi2(6)

Time: 13:37:39

Cov. Estimator: robust

Risk Premia Estimates

==============================================================================

Parameter Std. Err. T-stat P-value Lower CI Upper CI

------------------------------------------------------------------------------

MktRF 0.0073 0.0017 4.3856 0.0000 0.0040 0.0105

HML 0.0091 0.0027 3.4361 0.0006 0.0039 0.0143

Mom 0.0084 0.0015 5.7507 0.0000 0.0055 0.0113

==============================================================================

Covariance estimator:

HeteroskedasticCovariance

See full_summary for complete results

The risk-free rate can be optionally estimated. This is useful in case excess returns are not available of if the risk-free rate used to construct the excess returns might be misspecified.

Here the estimated risk-free rate is small and insignificant and has little impact on the model J-statistic.

[13]:

from linearmodels.asset_pricing import LinearFactorModel

factors = data[["MktRF", "HML", "Mom"]]

portfolios = data[

["S1M1", "S1M3", "S1M5", "S3M1", "S3M3", "S3M5", "S5M1", "S5M3", "S5M5"]

]

mod = LinearFactorModel(portfolios, factors, risk_free=True)

print(mod.fit())

LinearFactorModel Estimation Summary

================================================================================

No. Test Portfolios: 9 R-squared: 0.7915

No. Factors: 3 J-statistic: 36.003

No. Observations: 819 P-value 0.0000

Date: Tue, Oct 21 2025 Distribution: chi2(5)

Time: 13:37:39

Cov. Estimator: robust

Risk Premia Estimates

==============================================================================

Parameter Std. Err. T-stat P-value Lower CI Upper CI

------------------------------------------------------------------------------

risk_free -0.0045 0.0079 -0.5607 0.5750 -0.0200 0.0111

MktRF 0.0111 0.0076 1.4636 0.1433 -0.0038 0.0259

HML 0.0110 0.0053 2.0946 0.0362 0.0007 0.0214

Mom 0.0086 0.0014 5.9315 0.0000 0.0058 0.0114

==============================================================================

Covariance estimator:

HeteroskedasticCovariance

See full_summary for complete results

The default covariance estimator allows for heteroskedasticity but assumes there is no autocorrelation in the model errors or factor returns. Kernel-based HAC estimators (e.g. Newey-West) can be used by setting cov_type="kernel".

This reduces the J-statistic indicating there might be some serial correlation although the model is still firmly rejected.

[14]:

mod = LinearFactorModel(portfolios, factors)

print(mod.fit(cov_type="kernel"))

LinearFactorModel Estimation Summary

================================================================================

No. Test Portfolios: 9 R-squared: 0.7915

No. Factors: 3 J-statistic: 25.841

No. Observations: 819 P-value 0.0002

Date: Tue, Oct 21 2025 Distribution: chi2(6)

Time: 13:37:39

Cov. Estimator: kernel

Risk Premia Estimates

==============================================================================

Parameter Std. Err. T-stat P-value Lower CI Upper CI

------------------------------------------------------------------------------

MktRF 0.0073 0.0017 4.3094 0.0000 0.0040 0.0106

HML 0.0091 0.0031 2.9499 0.0032 0.0031 0.0152

Mom 0.0084 0.0014 5.8371 0.0000 0.0056 0.0112

==============================================================================

Covariance estimator:

KernelCovariance, Kernel: bartlett, Bandwidth: 12

See full_summary for complete results

GMM Estimation¶

The final estimator is the GMM estimator which is similar to estimating the 2-step model in a single step. In practice the GMM estimator is estimated at least twice, once to get an consistent estimate of the covariance of the moment conditions and the second time to efficiently estimate parameters.

The GMM estimator does not have a closed form and so a non-linear optimizer is required. The default output prints the progress every 10 iterations. Here the model is fit twice, which is the standard method to implement efficient GMM.

[15]:

from linearmodels.asset_pricing import LinearFactorModelGMM

mod = LinearFactorModelGMM(portfolios, factors)

res = mod.fit()

print(res)

Iteration: 0, Objective: 47.7579158282351

Iteration: 10, Objective: 28.10258618881301

Iteration: 20, Objective: 26.36138406887324

Iteration: 30, Objective: 26.019665546492007

Iteration: 40, Objective: 22.325343252968423

Iteration: 0, Objective: 22.519350241414017

Iteration: 10, Objective: 22.303730189544734

Iteration: 20, Objective: 22.22642653941578

Iteration: 30, Objective: 22.193080894810542

LinearFactorModelGMM Estimation Summary

================================================================================

No. Test Portfolios: 9 R-squared: 0.7904

No. Factors: 3 J-statistic: 22.067

No. Observations: 819 P-value 0.0012

Date: Tue, Oct 21 2025 Distribution: chi2(6)

Time: 13:37:41

Cov. Estimator: robust

Risk Premia Estimates

==============================================================================

Parameter Std. Err. T-stat P-value Lower CI Upper CI

------------------------------------------------------------------------------

MktRF 0.0067 0.0015 4.4335 0.0000 0.0037 0.0097

HML 0.0135 0.0023 5.8706 0.0000 0.0090 0.0180

Mom 0.0094 0.0014 6.5139 0.0000 0.0066 0.0123

==============================================================================

Covariance estimator:

HeteroskedasticCovariance

See full_summary for complete results

Kernel HAC estimators can be used with this estimator as well. Using a kernel HAC covariance also implies a Kernel HAC weighting matrix estimator.

Here the GMM estimator along with the HAC estimator indicates that these factors might be able to price this set of 9 test portfolios. disp=0 is used to suppress iterative output.

[16]:

res = mod.fit(cov_type="kernel", kernel="bartlett", disp=0)

print(res)

LinearFactorModelGMM Estimation Summary

================================================================================

No. Test Portfolios: 9 R-squared: 0.7901

No. Factors: 3 J-statistic: 13.833

No. Observations: 819 P-value 0.0316

Date: Tue, Oct 21 2025 Distribution: chi2(6)

Time: 13:37:44

Cov. Estimator: kernel

Risk Premia Estimates

==============================================================================

Parameter Std. Err. T-stat P-value Lower CI Upper CI

------------------------------------------------------------------------------

MktRF 0.0074 0.0014 5.1450 0.0000 0.0046 0.0102

HML 0.0137 0.0030 4.5918 0.0000 0.0078 0.0195

Mom 0.0078 0.0013 6.0849 0.0000 0.0053 0.0103

==============================================================================

Covariance estimator:

KernelCovariance, Kernel: bartlett, Bandwidth: 20

See full_summary for complete results

Iterating until convergence¶

The standard approach is efficient and uses 2-steps. The first consistently estimates parameters using a sub-optimal weighting matrix, and the second uses the optimal weighting matrix conditional using the first stage estimates.

This method can be repeated until convergence, or for a fixed number of steps using the steps keyword argument.

[17]:

res = mod.fit(steps=10, disp=25)

print(res)

Iteration: 0, Objective: 47.7579158282351

Iteration: 25, Objective: 26.28031931715628

Iteration: 0, Objective: 22.519350241414017

Iteration: 25, Objective: 22.22221725814185

Iteration: 0, Objective: 22.09415705992026

Iteration: 25, Objective: 22.09126661325285

Iteration: 0, Objective: 22.08879828597695

Iteration: 25, Objective: 22.088771421936666

Iteration: 0, Objective: 22.088622402796993

Iteration: 0, Objective: 22.088622326070173

LinearFactorModelGMM Estimation Summary

================================================================================

No. Test Portfolios: 9 R-squared: 0.7904

No. Factors: 3 J-statistic: 22.089

No. Observations: 819 P-value 0.0012

Date: Tue, Oct 21 2025 Distribution: chi2(6)

Time: 13:37:49

Cov. Estimator: robust

Risk Premia Estimates

==============================================================================

Parameter Std. Err. T-stat P-value Lower CI Upper CI

------------------------------------------------------------------------------

MktRF 0.0067 0.0015 4.4231 0.0000 0.0037 0.0096

HML 0.0135 0.0023 5.8726 0.0000 0.0090 0.0180

Mom 0.0094 0.0014 6.5017 0.0000 0.0066 0.0123

==============================================================================

Covariance estimator:

HeteroskedasticCovariance

See full_summary for complete results

Continuously Updating Estimator¶

The Continuously Updating Estimator (CUE) is optionally available using the flag use_cue. CUE jointly minimizes the J-statistic as a function of the moment conditions and the weighting matrix, rather than iterating between minimizing the J-statistic for a fixed weighting matrix and updating the weighting matrix.

Here the results are essentially the same as in the iterative approach.

[18]:

res = mod.fit(use_cue=True)

print(res)

Iteration: 0, Objective: 47.7579158282351

Iteration: 10, Objective: 28.10258618881301

Iteration: 20, Objective: 26.36138406887324

Iteration: 30, Objective: 26.019665546492007

Iteration: 40, Objective: 22.325343252968423

Iteration: 0, Objective: 22.524476248542637

Iteration: 10, Objective: 22.38605101192894

Iteration: 20, Objective: 22.339801125802502

Iteration: 30, Objective: 22.30830472911881

LinearFactorModelGMM Estimation Summary

================================================================================

No. Test Portfolios: 9 R-squared: 0.7903

No. Factors: 3 J-statistic: 22.719

No. Observations: 819 P-value 0.0009

Date: Tue, Oct 21 2025 Distribution: chi2(6)

Time: 13:37:56

Cov. Estimator: robust

Risk Premia Estimates

==============================================================================

Parameter Std. Err. T-stat P-value Lower CI Upper CI

------------------------------------------------------------------------------

MktRF 0.0067 0.0015 4.4157 0.0000 0.0037 0.0096

HML 0.0136 0.0023 5.8881 0.0000 0.0090 0.0181

Mom 0.0094 0.0014 6.4984 0.0000 0.0066 0.0123

==============================================================================

Covariance estimator:

HeteroskedasticCovariance

See full_summary for complete results