Using the Fixed Variance process¶

The FixedVariance volatility process can be used to implement zig-zag model estimation where two steps are repeated until convergence. This can be used to estimate models which may not be easy to estimate as a single process due to numerical issues or a high-dimensional parameter space.

This setup code is required to run in an IPython notebook

[1]:

import warnings

warnings.simplefilter('ignore')

%matplotlib inline

import matplotlib.pyplot as plt

import seaborn

seaborn.set_style('darkgrid')

plt.rc("figure", figsize=(16, 6))

plt.rc("savefig", dpi=90)

plt.rc("font",family="sans-serif")

plt.rc("font",size=14)

Setup¶

Imports used in this example.

[2]:

import datetime as dt

import numpy as np

Data¶

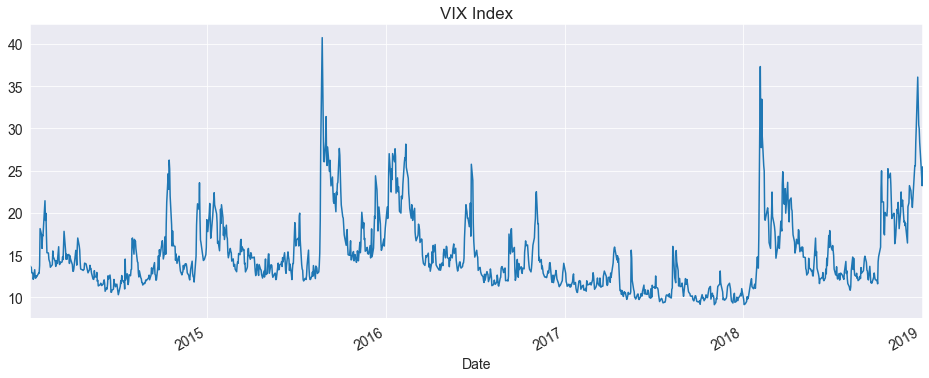

The VIX index will be used to illustrate the use of the FixedVariance process. The data is from FRED and is provided by the arch package.

[3]:

import arch.data.vix

vix_data = arch.data.vix.load()

vix = vix_data.vix.dropna()

vix.name = 'VIX Index'

ax = vix.plot(title='VIX Index')

Initial Mean Model Estimation¶

The first step is to estimate the mean to filter the residuals using a constant variance.

[4]:

from arch.univariate.mean import HARX, ZeroMean

from arch.univariate.volatility import GARCH, FixedVariance

mod = HARX(vix, lags=[1, 5, 22])

res = mod.fit()

print(res.summary())

HAR - Constant Variance Model Results

==============================================================================

Dep. Variable: VIX Index R-squared: 0.876

Mean Model: HAR Adj. R-squared: 0.876

Vol Model: Constant Variance Log-Likelihood: -2267.95

Distribution: Normal AIC: 4545.90

Method: Maximum Likelihood BIC: 4571.50

No. Observations: 1237

Date: Wed, Jan 29 2020 Df Residuals: 1232

Time: 18:15:35 Df Model: 5

Mean Model

================================================================================

coef std err t P>|t| 95.0% Conf. Int.

--------------------------------------------------------------------------------

Const 0.6335 0.189 3.359 7.831e-04 [ 0.264, 1.003]

VIX Index[0:1] 0.9287 6.589e-02 14.095 4.056e-45 [ 0.800, 1.058]

VIX Index[0:5] -0.0318 6.449e-02 -0.492 0.622 [ -0.158,9.463e-02]

VIX Index[0:22] 0.0612 3.180e-02 1.926 5.409e-02 [-1.076e-03, 0.124]

Volatility Model

========================================================================

coef std err t P>|t| 95.0% Conf. Int.

------------------------------------------------------------------------

sigma2 2.2910 0.396 5.782 7.361e-09 [ 1.514, 3.068]

========================================================================

Covariance estimator: White's Heteroskedasticity Consistent Estimator

Initial Volatility Model Estimation¶

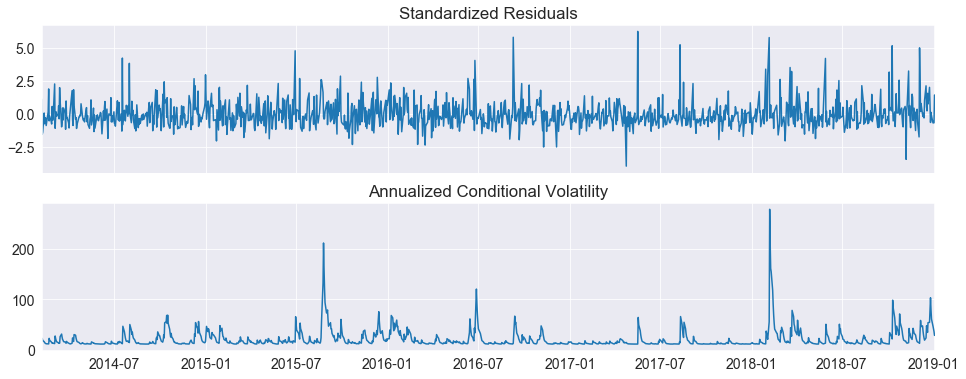

Using the previously estimated residuals, a volatility model can be estimated using a ZeroMean. In this example, a GJR-GARCH process is used for the variance.

[5]:

vol_mod = ZeroMean(res.resid.dropna(), volatility=GARCH(p=1, o=1, q=1))

vol_res = vol_mod.fit(disp='off')

print(vol_res.summary())

Zero Mean - GJR-GARCH Model Results

==============================================================================

Dep. Variable: resid R-squared: 0.000

Mean Model: Zero Mean Adj. R-squared: 0.001

Vol Model: GJR-GARCH Log-Likelihood: -1936.93

Distribution: Normal AIC: 3881.86

Method: Maximum Likelihood BIC: 3902.35

No. Observations: 1237

Date: Wed, Jan 29 2020 Df Residuals: 1233

Time: 18:15:36 Df Model: 4

Volatility Model

===========================================================================

coef std err t P>|t| 95.0% Conf. Int.

---------------------------------------------------------------------------

omega 0.2355 9.134e-02 2.578 9.932e-03 [5.647e-02, 0.415]

alpha[1] 0.7217 0.374 1.931 5.353e-02 [-1.098e-02, 1.454]

gamma[1] -0.7217 0.252 -2.859 4.255e-03 [ -1.217, -0.227]

beta[1] 0.5789 0.184 3.140 1.692e-03 [ 0.218, 0.940]

===========================================================================

Covariance estimator: robust

[6]:

ax = vol_res.plot('D')

Re-estimating the mean with a FixedVariance¶

The FixedVariance requires that the variance is provided when initializing the object. The variance provided should have the same shape as the original data. Since the variance estimated from the GJR-GARCH model is missing the first 22 observations due to the HAR lags, we simply fill these with 1. These values will not be used to estimate the model, and so the value is not important.

The summary shows that there is a single parameter, scale, which is close to 1. The mean parameters have changed which reflects the GLS-like weighting that this re-estimation imposes.

[7]:

variance = np.empty_like(vix)

variance.fill(1.0)

variance[22:] = vol_res.conditional_volatility**2.0

fv = FixedVariance(variance)

mod = HARX(vix, lags=[1, 5, 22], volatility=fv)

res = mod.fit()

print(res.summary())

Iteration: 1, Func. Count: 7, Neg. LLF: 1936.9320776132129

Iteration: 2, Func. Count: 20, Neg. LLF: 1936.2884244078432

Iteration: 3, Func. Count: 30, Neg. LLF: 1936.173303940313

Iteration: 4, Func. Count: 39, Neg. LLF: 1936.1217869245936

Iteration: 5, Func. Count: 48, Neg. LLF: 1936.066653561499

Iteration: 6, Func. Count: 58, Neg. LLF: 1936.063430293817

Iteration: 7, Func. Count: 65, Neg. LLF: 1935.9527544039636

Iteration: 8, Func. Count: 72, Neg. LLF: 1935.9470521933054

Optimization terminated successfully. (Exit mode 0)

Current function value: 1935.947051582333

Iterations: 8

Function evaluations: 73

Gradient evaluations: 8

HAR - Fixed Variance Model Results

==============================================================================

Dep. Variable: VIX Index R-squared: 0.876

Mean Model: HAR Adj. R-squared: 0.876

Vol Model: Fixed Variance Log-Likelihood: -1935.95

Distribution: Normal AIC: 3881.89

Method: Maximum Likelihood BIC: 3907.50

No. Observations: 1237

Date: Wed, Jan 29 2020 Df Residuals: 1232

Time: 18:15:37 Df Model: 5

Mean Model

==================================================================================

coef std err t P>|t| 95.0% Conf. Int.

----------------------------------------------------------------------------------

Const 0.5584 0.153 3.661 2.507e-04 [ 0.260, 0.857]

VIX Index[0:1] 0.9376 3.625e-02 25.866 1.607e-147 [ 0.867, 1.009]

VIX Index[0:5] -0.0249 3.782e-02 -0.657 0.511 [-9.899e-02,4.926e-02]

VIX Index[0:22] 0.0493 2.102e-02 2.344 1.909e-02 [8.064e-03,9.044e-02]

Volatility Model

========================================================================

coef std err t P>|t| 95.0% Conf. Int.

------------------------------------------------------------------------

scale 0.9986 8.081e-02 12.358 4.420e-35 [ 0.840, 1.157]

========================================================================

Covariance estimator: robust

Zig-Zag estimation¶

A small repetitions of the previous two steps can be used to implement a so-called zig-zag estimation strategy.

[8]:

for i in range(5):

print(i)

vol_mod = ZeroMean(res.resid.dropna(), volatility=GARCH(p=1, o=1, q=1))

vol_res = vol_mod.fit(disp='off')

variance[22:] = vol_res.conditional_volatility**2.0

fv = FixedVariance(variance, unit_scale=True)

mod = HARX(vix, lags=[1, 5, 22], volatility=fv)

res = mod.fit(disp='off')

print(res.summary())

0

1

2

3

4

HAR - Fixed Variance (Unit Scale) Model Results

=======================================================================================

Dep. Variable: VIX Index R-squared: 0.876

Mean Model: HAR Adj. R-squared: 0.876

Vol Model: Fixed Variance (Unit Scale) Log-Likelihood: -1935.74

Distribution: Normal AIC: 3879.48

Method: Maximum Likelihood BIC: 3899.96

No. Observations: 1237

Date: Wed, Jan 29 2020 Df Residuals: 1233

Time: 18:15:37 Df Model: 4

Mean Model

=================================================================================

coef std err t P>|t| 95.0% Conf. Int.

---------------------------------------------------------------------------------

Const 0.5602 0.152 3.681 2.323e-04 [ 0.262, 0.858]

VIX Index[0:1] 0.9381 3.616e-02 25.940 2.388e-148 [ 0.867, 1.009]

VIX Index[0:5] -0.0262 3.774e-02 -0.693 0.488 [ -0.100,4.781e-02]

VIX Index[0:22] 0.0499 2.099e-02 2.380 1.733e-02 [8.810e-03,9.109e-02]

=================================================================================

Covariance estimator: robust

Direct Estimation¶

This model can be directly estimated. The results are provided for comparison to the previous FixedVariance estimates of the mean parameters.

[9]:

mod = HARX(vix, lags=[1, 5, 22], volatility=GARCH(1, 1, 1))

res = mod.fit(disp='off')

print(res.summary())

HAR - GJR-GARCH Model Results

==============================================================================

Dep. Variable: VIX Index R-squared: 0.876

Mean Model: HAR Adj. R-squared: 0.875

Vol Model: GJR-GARCH Log-Likelihood: -1932.61

Distribution: Normal AIC: 3881.23

Method: Maximum Likelihood BIC: 3922.19

No. Observations: 1237

Date: Wed, Jan 29 2020 Df Residuals: 1229

Time: 18:15:38 Df Model: 8

Mean Model

================================================================================

coef std err t P>|t| 95.0% Conf. Int.

--------------------------------------------------------------------------------

Const 0.7796 1.190 0.655 0.513 [ -1.554, 3.113]

VIX Index[0:1] 0.9180 0.291 3.156 1.597e-03 [ 0.348, 1.488]

VIX Index[0:5] -0.0393 0.296 -0.133 0.894 [ -0.620, 0.541]

VIX Index[0:22] 0.0632 6.353e-02 0.994 0.320 [-6.136e-02, 0.188]

Volatility Model

========================================================================

coef std err t P>|t| 95.0% Conf. Int.

------------------------------------------------------------------------

omega 0.2357 0.250 0.944 0.345 [ -0.254, 0.725]

alpha[1] 0.7091 1.069 0.664 0.507 [ -1.386, 2.804]

gamma[1] -0.7091 0.519 -1.367 0.172 [ -1.726, 0.308]

beta[1] 0.5579 0.855 0.653 0.514 [ -1.117, 2.233]

========================================================================

Covariance estimator: robust