Volatility Scenarios¶

Custom random-number generators can be used to implement scenarios where shock follow a particular pattern. For example, suppose you wanted to find out what would happen if there were 5 days of shocks that were larger than average. In most circumstances, the shocks in a GARCH model have unit variance. This could be changed so that the first 5 shocks have variance 4, or twice the standard deviation.

Another scenario would be to over sample a specific period for the shocks. When using the standard bootstrap method (filtered historical simulation) the shocks are drawn using iid sampling from the history. While this approach is standard and well-grounded, it might be desirable to sample from a specific period. This can be implemented using a custom random number generator. This strategy is precisely how the filtered historical simulation is implemented internally, only where the draws are uniformly sampled from the entire history.

First, some preliminaries

[1]:

%matplotlib inline

import matplotlib.pyplot as plt

import numpy as np

import pandas as pd

import seaborn as sns

from arch.univariate import GARCH, ConstantMean, Normal

%matplotlib inline

import matplotlib.pyplot as plt

sns.set_style('darkgrid')

plt.rc("figure", figsize=(16, 6))

plt.rc("savefig", dpi=90)

plt.rc("font",family="sans-serif")

plt.rc("font",size=14)

This example makes use of returns from the NASDAQ index. The scenario bootstrap will make use of returns in the run-up to and during the Financial Crisis of 2008.

[2]:

import arch.data.nasdaq

data = arch.data.nasdaq.load()

nasdaq = data['Adj Close']

print(nasdaq.head())

Date

1999-01-04 2208.050049

1999-01-05 2251.270020

1999-01-06 2320.860107

1999-01-07 2326.090088

1999-01-08 2344.409912

Name: Adj Close, dtype: float64

Next, the returns are computed and the model is constructed. The model is constructed from the building blocks. It is a standard model and could have been (almost) equivalently constructed using

mod = arch_model(rets, mean='constant', p=1, o=1, q=1)

The one advantage of constructing the model using the components is that the NumPy RandomState that is used to simulate from the model can be externally set. This allows the generator seed to be easily set and for the state to reset, if needed.

NOTE: It is always a good idea to scale return by 100 before estimating ARCH-type models. This helps the optimizer converse since the scale of the volatility intercept is much closer to the scale of the other parameters in the model.

[3]:

rets = 100 * nasdaq.pct_change().dropna()

# Build components to set the state for the distribution

random_state = np.random.RandomState(1)

dist = Normal(random_state=random_state)

volatility = GARCH(1, 1, 1)

mod = ConstantMean(rets, volatility=volatility, distribution=dist)

Fitting the model is standard.

[4]:

res = mod.fit(disp='off')

res

[4]:

Constant Mean - GJR-GARCH Model Results

==============================================================================

Dep. Variable: Adj Close R-squared: -0.000

Mean Model: Constant Mean Adj. R-squared: -0.000

Vol Model: GJR-GARCH Log-Likelihood: -8196.75

Distribution: Normal AIC: 16403.5

Method: Maximum Likelihood BIC: 16436.1

No. Observations: 5030

Date: Wed, Jan 29 2020 Df Residuals: 5025

Time: 18:15:23 Df Model: 5

Mean Model

============================================================================

coef std err t P>|t| 95.0% Conf. Int.

----------------------------------------------------------------------------

mu 0.0376 1.476e-02 2.549 1.081e-02 [8.693e-03,6.656e-02]

Volatility Model

=============================================================================

coef std err t P>|t| 95.0% Conf. Int.

-----------------------------------------------------------------------------

omega 0.0214 5.001e-03 4.281 1.861e-05 [1.161e-02,3.121e-02]

alpha[1] 0.0152 8.442e-03 1.802 7.148e-02 [-1.330e-03,3.176e-02]

gamma[1] 0.1265 2.024e-02 6.250 4.109e-10 [8.684e-02, 0.166]

beta[1] 0.9100 1.107e-02 82.232 0.000 [ 0.888, 0.932]

=============================================================================

Covariance estimator: robust

ARCHModelResult, id: 0x233a0373a88

GJR-GARCH models support analytical forecasts, which is the default. The forecasts are produced for all of 2017 using the estimated model parameters.

[5]:

forecasts = res.forecast(start='1-1-2017', horizon=10)

print(forecasts.residual_variance.dropna().head())

h.01 h.02 h.03 h.04 h.05 h.06 \

Date

2017-01-03 0.623295 0.637504 0.651549 0.665431 0.679154 0.692717

2017-01-04 0.599455 0.613940 0.628257 0.642408 0.656397 0.670223

2017-01-05 0.567297 0.582153 0.596837 0.611352 0.625699 0.639880

2017-01-06 0.542506 0.557649 0.572616 0.587410 0.602034 0.616488

2017-01-09 0.515452 0.530906 0.546183 0.561282 0.576208 0.590961

h.07 h.08 h.09 h.10

Date

2017-01-03 0.706124 0.719376 0.732475 0.745423

2017-01-04 0.683890 0.697399 0.710752 0.723950

2017-01-05 0.653897 0.667753 0.681448 0.694985

2017-01-06 0.630776 0.644899 0.658858 0.672656

2017-01-09 0.605543 0.619957 0.634205 0.648288

All GARCH specification are complete models in the sense that they specify a distribution. This allows simulations to be produced using the assumptions in the model. The forecast function can be made to produce simulations using the assumed distribution by setting method='simulation'.

These forecasts are similar to the analytical forecasts above. As the number of simulation increases towards \(\infty\), the simulation-based forecasts will converge to the analytical values above.

[6]:

sim_forecasts = res.forecast(start='1-1-2017', method='simulation', horizon=10)

print(sim_forecasts.residual_variance.dropna().head())

h.01 h.02 h.03 h.04 h.05 h.06 \

Date

2017-01-03 0.623295 0.637251 0.647817 0.663746 0.673404 0.687952

2017-01-04 0.599455 0.617539 0.635838 0.649695 0.659733 0.667267

2017-01-05 0.567297 0.583415 0.597571 0.613065 0.621790 0.636180

2017-01-06 0.542506 0.555688 0.570280 0.585426 0.595551 0.608487

2017-01-09 0.515452 0.528771 0.542658 0.559684 0.580434 0.594855

h.07 h.08 h.09 h.10

Date

2017-01-03 0.697221 0.707707 0.717701 0.729465

2017-01-04 0.686503 0.699708 0.707203 0.718560

2017-01-05 0.650287 0.663344 0.679835 0.692300

2017-01-06 0.619195 0.638180 0.653185 0.661366

2017-01-09 0.605136 0.621835 0.634091 0.653222

Custom Random Generators¶

forecast supports replacing the generator based on the assumed distribution of residuals in the model with any other generator. A shock generator should usually produce unit variance shocks. However, in this example the first 5 shocks generated have variance 2, and the remainder are standard normal. This scenario consists of a period of consistently surprising volatility where the volatility has shifted for some reason.

The forecast variances are much larger and grow faster than those from either method previously illustrated. This reflects the increase in volatility in the first 5 days.

[7]:

import numpy as np

random_state = np.random.RandomState(1)

def scenario_rng(size):

shocks = random_state.standard_normal(size)

shocks[:, :5] *= np.sqrt(2)

return shocks

scenario_forecasts = res.forecast(

start='1-1-2017', method='simulation', horizon=10, rng=scenario_rng)

print(scenario_forecasts.residual_variance.dropna().head())

h.01 h.02 h.03 h.04 h.05 h.06 \

Date

2017-01-03 0.623295 0.685911 0.745202 0.821112 0.886289 0.966737

2017-01-04 0.599455 0.668181 0.743119 0.811486 0.877539 0.936587

2017-01-05 0.567297 0.629195 0.691225 0.758891 0.816663 0.893986

2017-01-06 0.542506 0.596301 0.656603 0.721505 0.778286 0.849680

2017-01-09 0.515452 0.567086 0.622224 0.689831 0.775048 0.845656

h.07 h.08 h.09 h.10

Date

2017-01-03 0.970796 0.977504 0.982202 0.992547

2017-01-04 0.955295 0.965540 0.966432 0.974248

2017-01-05 0.905952 0.915208 0.930777 0.938636

2017-01-06 0.856175 0.873866 0.886221 0.890002

2017-01-09 0.851104 0.864591 0.874696 0.894397

Bootstrap Scenarios¶

forecast supports Filtered Historical Simulation (FHS) using method='bootstrap'. This is effectively a simulation method where the simulated shocks are generated using iid sampling from the history of the demeaned and standardized return data. Custom bootstraps are another application of rng. Here an object is used to hold the shocks. This object exposes a method (rng) the acts like a random number generator, except that it only returns values that were provided in the shocks parameter.

The internal implementation of the FHS uses a method almost identical to this where shocks contain the entire history.

[8]:

class ScenarioBootstrapRNG(object):

def __init__(self, shocks, random_state):

self._shocks = np.asarray(shocks) # 1d

self._rs = random_state

self.n = shocks.shape[0]

def rng(self, size):

idx = self._rs.randint(0, self.n, size=size)

return self._shocks[idx]

random_state = np.random.RandomState(1)

std_shocks = res.resid / res.conditional_volatility

shocks = std_shocks['2008-08-01':'2008-11-10']

scenario_bootstrap = ScenarioBootstrapRNG(shocks, random_state)

bs_forecasts = res.forecast(

start='1-1-2017',

method='simulation',

horizon=10,

rng=scenario_bootstrap.rng)

print(bs_forecasts.residual_variance.dropna().head())

h.01 h.02 h.03 h.04 h.05 h.06 \

Date

2017-01-03 0.623295 0.676081 0.734322 0.779325 0.828189 0.898202

2017-01-04 0.599455 0.645237 0.697133 0.750169 0.816280 0.888417

2017-01-05 0.567297 0.610493 0.665995 0.722954 0.777860 0.840369

2017-01-06 0.542506 0.597387 0.644534 0.691387 0.741206 0.783319

2017-01-09 0.515452 0.561312 0.611026 0.647824 0.700559 0.757398

h.07 h.08 h.09 h.10

Date

2017-01-03 0.958215 1.043704 1.124684 1.203893

2017-01-04 0.945120 1.013400 1.084043 1.158148

2017-01-05 0.889032 0.961424 1.022413 1.097192

2017-01-06 0.840667 0.895559 0.957266 1.019497

2017-01-09 0.820788 0.887791 0.938708 1.028614

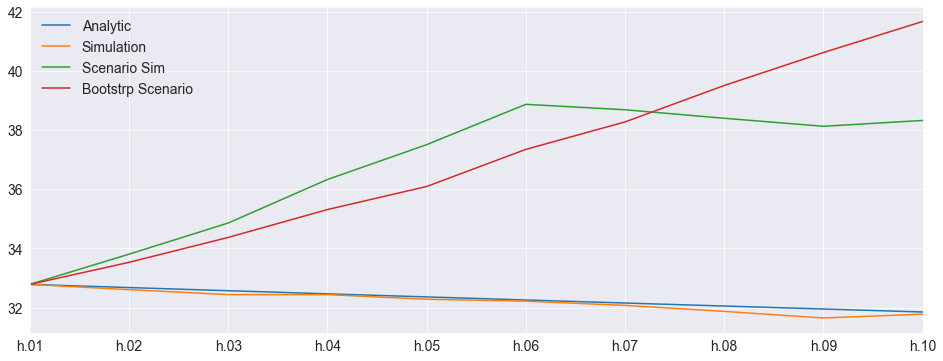

Visualizing the differences¶

The final forecast values are used to illustrate how these are different. The analytical and standard simulation are virtually identical. The simulated scenario grows rapidly for the first 5 periods and then more slowly. The bootstrap scenario grows quickly and consistently due to the magnitude of the shocks in the financial crisis.

[9]:

import pandas as pd

df = pd.concat([

forecasts.residual_variance.iloc[-1],

sim_forecasts.residual_variance.iloc[-1],

scenario_forecasts.residual_variance.iloc[-1],

bs_forecasts.residual_variance.iloc[-1]

], 1)

df.columns = ['Analytic', 'Simulation', 'Scenario Sim', 'Bootstrp Scenario']

# Plot annualized vol

subplot = np.sqrt(252 * df).plot(legend=False)

legend = subplot.legend(frameon=False)

[10]:

subplot = np.sqrt(252 * df).plot

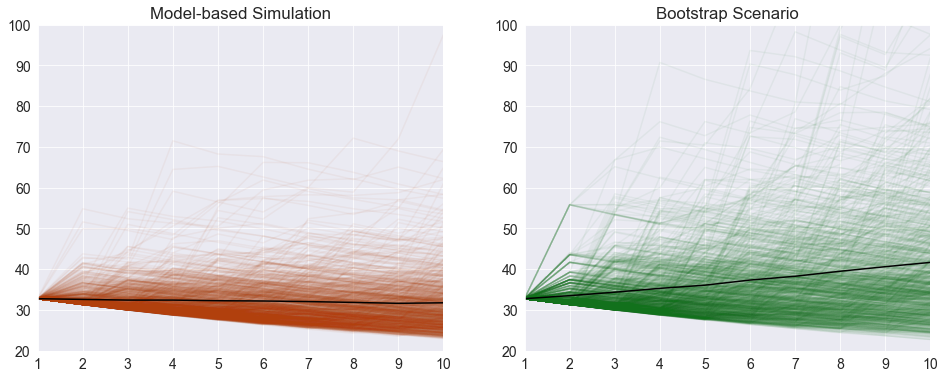

Comparing the paths¶

The paths are available on the attribute simulations. Plotting the paths shows important differences between the two scenarios beyond the average differences plotted above. Both start at the same point.

[11]:

fig, axes = plt.subplots(1, 2)

colors = sns.color_palette('dark')

# The paths for the final observation

sim_paths = sim_forecasts.simulations.residual_variances[-1].T

bs_paths = bs_forecasts.simulations.residual_variances[-1].T

x = np.arange(1, 11)

# Plot the paths and the mean, set the axis to have the same limit

axes[0].plot(x, np.sqrt(252 * sim_paths), color=colors[1], alpha=0.05)

axes[0].plot(

x,

np.sqrt(252 * sim_forecasts.residual_variance.iloc[-1]),

color='k',

alpha=1)

axes[0].set_title('Model-based Simulation')

axes[0].set_xticks(np.arange(1, 11))

axes[0].set_xlim(1, 10)

axes[0].set_ylim(20, 100)

axes[1].plot(x, np.sqrt(252 * bs_paths), color=colors[2], alpha=0.05)

axes[1].plot(

x,

np.sqrt(252 * bs_forecasts.residual_variance.iloc[-1]),

color='k',

alpha=1)

axes[1].set_xticks(np.arange(1, 11))

axes[1].set_xlim(1, 10)

axes[1].set_ylim(20, 100)

title = axes[1].set_title('Bootstrap Scenario')

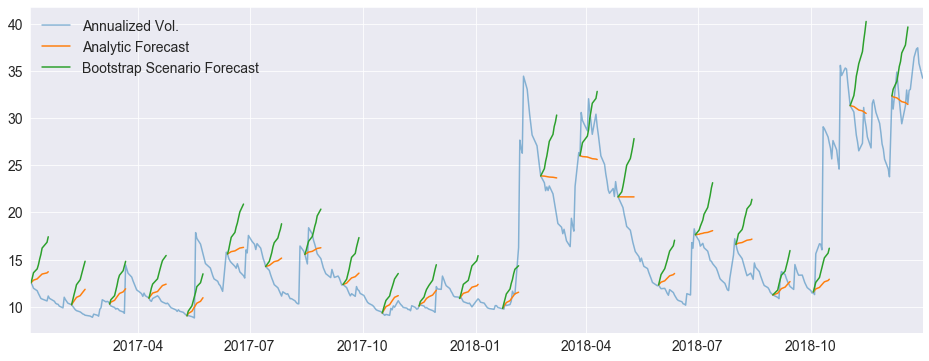

Comparing across the year¶

A hedgehog plot is useful for showing the differences between the two forecasting methods across the year, instead of a single day.

[12]:

analytic = forecasts.residual_variance.dropna()

bs = bs_forecasts.residual_variance.dropna()

fig, ax = plt.subplots(1, 1)

vol = res.conditional_volatility['2017-1-1':'2019-1-1']

idx = vol.index

ax.plot(np.sqrt(252) * vol, alpha=0.5)

colors = sns.color_palette()

for i in range(0, len(vol), 22):

a = analytic.iloc[i]

b = bs.iloc[i]

loc = idx.get_loc(a.name)

new_idx = idx[loc + 1:loc + 11]

a.index = new_idx

b.index = new_idx

ax.plot(np.sqrt(252 * a), color=colors[1])

ax.plot(np.sqrt(252 * b), color=colors[2])

labels = [

'Annualized Vol.', 'Analytic Forecast', 'Bootstrap Scenario Forecast'

]

legend = ax.legend(labels, frameon=False)

xlim = ax.set_xlim(vol.index[0], vol.index[-1])