ARCH Modeling¶

This setup code is required to run in an IPython notebook

[1]:

import matplotlib.pyplot as plt

import seaborn as sns

sns.set_style("darkgrid")

plt.rc("figure", figsize=(16, 6))

plt.rc("savefig", dpi=90)

plt.rc("font", family="sans-serif")

plt.rc("font", size=14)

Setup¶

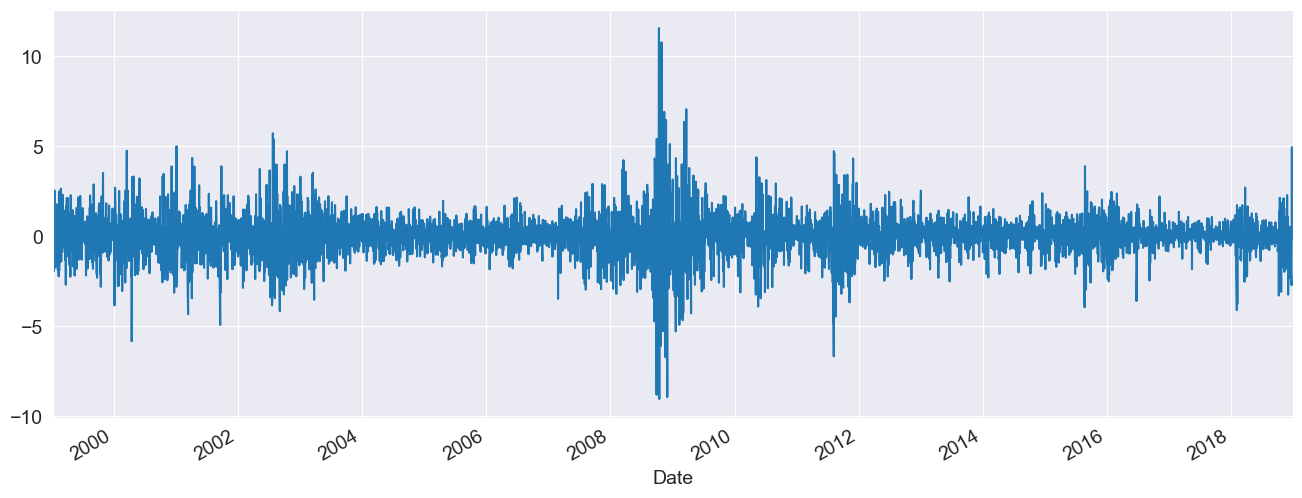

These examples will all make use of financial data from Yahoo! Finance. This data set can be loaded from arch.data.sp500.

[2]:

import datetime as dt

import arch.data.sp500

st = dt.datetime(1988, 1, 1)

en = dt.datetime(2018, 1, 1)

data = arch.data.sp500.load()

market = data["Adj Close"]

returns = 100 * market.pct_change().dropna()

ax = returns.plot()

xlim = ax.set_xlim(returns.index.min(), returns.index.max())

Specifying Common Models¶

The simplest way to specify a model is to use the model constructor arch.arch_model which can specify most common models. The simplest invocation of arch will return a model with a constant mean, GARCH(1,1) volatility process and normally distributed errors.

The model is estimated by calling fit. The optional inputs iter controls the frequency of output form the optimizer, and disp controls whether convergence information is returned. The results class returned offers direct access to the estimated parameters and related quantities, as well as a summary of the estimation results.

GARCH (with a Constant Mean)¶

The default set of options produces a model with a constant mean, GARCH(1,1) conditional variance and normal errors.

[3]:

from arch import arch_model

am = arch_model(returns)

res = am.fit(update_freq=5)

print(res.summary())

Iteration: 5, Func. Count: 35, Neg. LLF: 6970.284960008103

Iteration: 10, Func. Count: 63, Neg. LLF: 6936.718477484757

Optimization terminated successfully (Exit mode 0)

Current function value: 6936.718476988985

Iterations: 11

Function evaluations: 68

Gradient evaluations: 11

Constant Mean - GARCH Model Results

==============================================================================

Dep. Variable: Adj Close R-squared: 0.000

Mean Model: Constant Mean Adj. R-squared: 0.000

Vol Model: GARCH Log-Likelihood: -6936.72

Distribution: Normal AIC: 13881.4

Method: Maximum Likelihood BIC: 13907.5

No. Observations: 5030

Date: Mon, Mar 09 2026 Df Residuals: 5029

Time: 13:00:53 Df Model: 1

Mean Model

============================================================================

coef std err t P>|t| 95.0% Conf. Int.

----------------------------------------------------------------------------

mu 0.0564 1.149e-02 4.906 9.302e-07 [3.384e-02,7.887e-02]

Volatility Model

============================================================================

coef std err t P>|t| 95.0% Conf. Int.

----------------------------------------------------------------------------

omega 0.0175 4.683e-03 3.738 1.854e-04 [8.328e-03,2.669e-02]

alpha[1] 0.1022 1.301e-02 7.852 4.105e-15 [7.665e-02, 0.128]

beta[1] 0.8852 1.380e-02 64.125 0.000 [ 0.858, 0.912]

============================================================================

Covariance estimator: robust

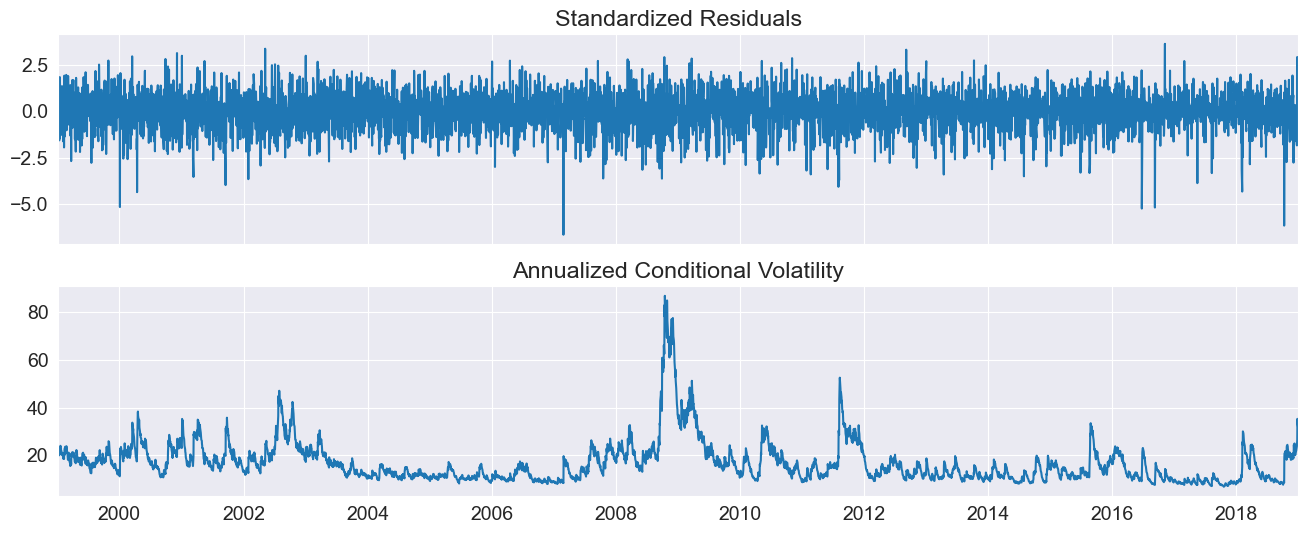

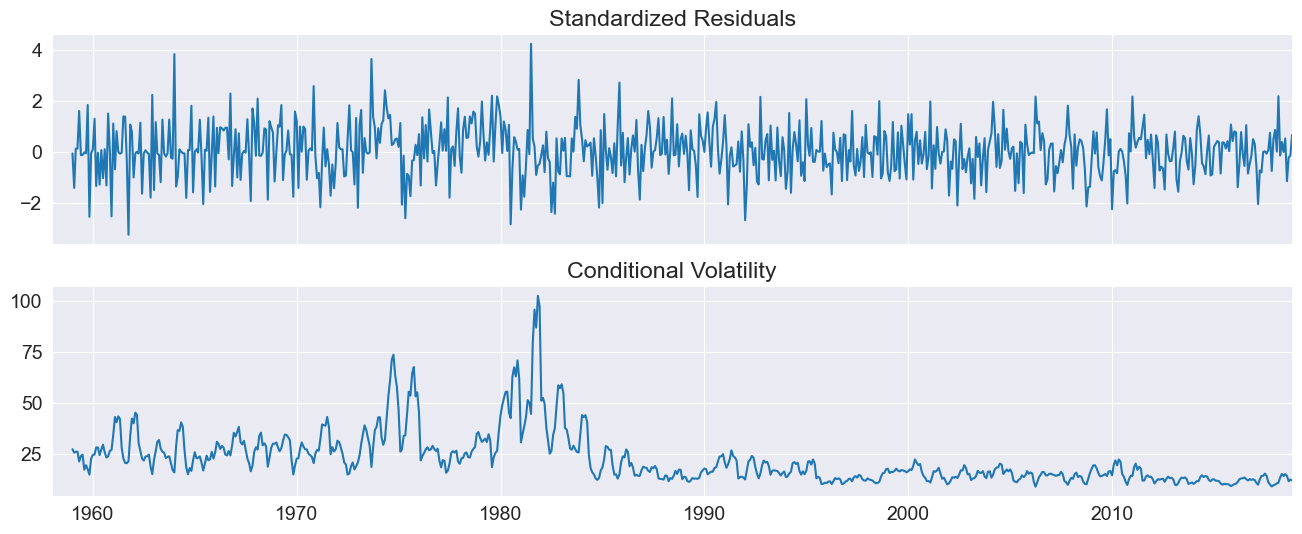

plot() can be used to quickly visualize the standardized residuals and conditional volatility.

[4]:

fig = res.plot(annualize="D")

GJR-GARCH¶

Additional inputs can be used to construct other models. This example sets o to 1, which includes one lag of an asymmetric shock which transforms a GARCH model into a GJR-GARCH model with variance dynamics given by

where \(I\) is an indicator function that takes the value 1 when its argument is true.

The log likelihood improves substantially with the introduction of an asymmetric term, and the parameter estimate is highly significant.

[5]:

am = arch_model(returns, p=1, o=1, q=1)

res = am.fit(update_freq=5, disp="off")

print(res.summary())

Constant Mean - GJR-GARCH Model Results

==============================================================================

Dep. Variable: Adj Close R-squared: 0.000

Mean Model: Constant Mean Adj. R-squared: 0.000

Vol Model: GJR-GARCH Log-Likelihood: -6822.88

Distribution: Normal AIC: 13655.8

Method: Maximum Likelihood BIC: 13688.4

No. Observations: 5030

Date: Mon, Mar 09 2026 Df Residuals: 5029

Time: 13:00:54 Df Model: 1

Mean Model

=============================================================================

coef std err t P>|t| 95.0% Conf. Int.

-----------------------------------------------------------------------------

mu 0.0175 1.145e-02 1.529 0.126 [-4.936e-03,3.995e-02]

Volatility Model

=============================================================================

coef std err t P>|t| 95.0% Conf. Int.

-----------------------------------------------------------------------------

omega 0.0196 4.051e-03 4.830 1.362e-06 [1.163e-02,2.751e-02]

alpha[1] 4.1325e-11 1.026e-02 4.027e-09 1.000 [-2.011e-02,2.011e-02]

gamma[1] 0.1831 2.266e-02 8.079 6.543e-16 [ 0.139, 0.227]

beta[1] 0.8922 1.458e-02 61.200 0.000 [ 0.864, 0.921]

=============================================================================

Covariance estimator: robust

TARCH/ZARCH¶

TARCH (also known as ZARCH) model the volatility using absolute values. This model is specified using power=1.0 since the default power, 2, corresponds to variance processes that evolve in squares.

The volatility process in a TARCH model is given by

More general models with other powers (\(\kappa\)) have volatility dynamics given by

where the conditional variance is \(\left(\sigma_t^\kappa\right)^{2/\kappa}\).

The TARCH model also improves the fit, although the change in the log likelihood is less dramatic.

[6]:

am = arch_model(returns, p=1, o=1, q=1, power=1.0)

res = am.fit(update_freq=5)

print(res.summary())

Iteration: 5, Func. Count: 45, Neg. LLF: 6829.2531610519045

Iteration: 10, Func. Count: 79, Neg. LLF: 6799.17861626466

Optimization terminated successfully (Exit mode 0)

Current function value: 6799.178524134302

Iterations: 15

Function evaluations: 109

Gradient evaluations: 14

Constant Mean - TARCH/ZARCH Model Results

==============================================================================

Dep. Variable: Adj Close R-squared: 0.000

Mean Model: Constant Mean Adj. R-squared: 0.000

Vol Model: TARCH/ZARCH Log-Likelihood: -6799.18

Distribution: Normal AIC: 13608.4

Method: Maximum Likelihood BIC: 13641.0

No. Observations: 5030

Date: Mon, Mar 09 2026 Df Residuals: 5029

Time: 13:00:54 Df Model: 1

Mean Model

=============================================================================

coef std err t P>|t| 95.0% Conf. Int.

-----------------------------------------------------------------------------

mu 0.0143 1.091e-02 1.312 0.190 [-7.078e-03,3.571e-02]

Volatility Model

=============================================================================

coef std err t P>|t| 95.0% Conf. Int.

-----------------------------------------------------------------------------

omega 0.0258 4.100e-03 6.299 2.991e-10 [1.779e-02,3.386e-02]

alpha[1] 1.0673e-08 9.155e-03 1.166e-06 1.000 [-1.794e-02,1.794e-02]

gamma[1] 0.1707 1.601e-02 10.664 1.504e-26 [ 0.139, 0.202]

beta[1] 0.9098 9.671e-03 94.069 0.000 [ 0.891, 0.929]

=============================================================================

Covariance estimator: robust

Student’s T Errors¶

Financial returns are often heavy tailed, and a Student’s T distribution is a simple method to capture this feature. The call to arch changes the distribution from a Normal to a Students’s T.

The standardized residuals appear to be heavy tailed with an estimated degree of freedom near 10. The log-likelihood also shows a large increase.

[7]:

am = arch_model(returns, p=1, o=1, q=1, power=1.0, dist="StudentsT")

res = am.fit(update_freq=5)

print(res.summary())

Iteration: 5, Func. Count: 50, Neg. LLF: 6729.018971432843

Iteration: 10, Func. Count: 90, Neg. LLF: 6722.151182116935

Optimization terminated successfully (Exit mode 0)

Current function value: 6722.151181606961

Iterations: 11

Function evaluations: 98

Gradient evaluations: 11

Constant Mean - TARCH/ZARCH Model Results

====================================================================================

Dep. Variable: Adj Close R-squared: 0.000

Mean Model: Constant Mean Adj. R-squared: 0.000

Vol Model: TARCH/ZARCH Log-Likelihood: -6722.15

Distribution: Standardized Student's t AIC: 13456.3

Method: Maximum Likelihood BIC: 13495.4

No. Observations: 5030

Date: Mon, Mar 09 2026 Df Residuals: 5029

Time: 13:00:54 Df Model: 1

Mean Model

============================================================================

coef std err t P>|t| 95.0% Conf. Int.

----------------------------------------------------------------------------

mu 0.0323 2.765e-03 11.669 1.840e-31 [2.684e-02,3.768e-02]

Volatility Model

=============================================================================

coef std err t P>|t| 95.0% Conf. Int.

-----------------------------------------------------------------------------

omega 0.0201 3.498e-03 5.736 9.688e-09 [1.321e-02,2.692e-02]

alpha[1] 0.0000 8.224e-03 0.000 1.000 [-1.612e-02,1.612e-02]

gamma[1] 0.1721 1.513e-02 11.380 5.284e-30 [ 0.142, 0.202]

beta[1] 0.9139 9.578e-03 95.416 0.000 [ 0.895, 0.933]

Distribution

========================================================================

coef std err t P>|t| 95.0% Conf. Int.

------------------------------------------------------------------------

nu 7.9553 0.881 9.032 1.689e-19 [ 6.229, 9.682]

========================================================================

Covariance estimator: robust

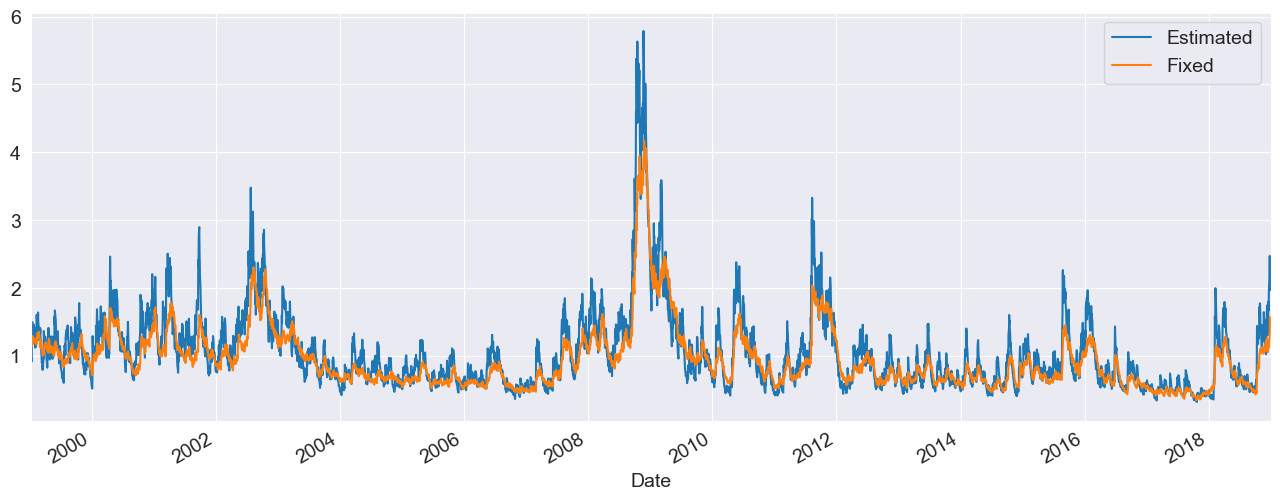

Fixing Parameters¶

In some circumstances, fixed rather than estimated parameters might be of interest. A model-result-like class can be generated using the fix() method. The class returned is identical to the usual model result class except that information about inference (standard errors, t-stats, etc) is not available.

In the example, I fix the parameters to a symmetric version of the previously estimated model.

[8]:

fixed_res = am.fix([0.0235, 0.01, 0.06, 0.0, 0.9382, 8.0])

print(fixed_res.summary())

Constant Mean - TARCH/ZARCH Model Results

=====================================================================================

Dep. Variable: Adj Close R-squared: --

Mean Model: Constant Mean Adj. R-squared: --

Vol Model: TARCH/ZARCH Log-Likelihood: -6908.93

Distribution: Standardized Student's t AIC: 13829.9

Method: User-specified Parameters BIC: 13869.0

No. Observations: 5030

Date: Mon, Mar 09 2026

Time: 13:00:54

Mean Model

=====================

coef

---------------------

mu 0.0235

Volatility Model

=====================

coef

---------------------

omega 0.0100

alpha[1] 0.0600

gamma[1] 0.0000

beta[1] 0.9382

Distribution

=====================

coef

---------------------

nu 8.0000

=====================

Results generated with user-specified parameters.

Std. errors not available when the model is not estimated,

[9]:

import pandas as pd

df = pd.concat([res.conditional_volatility, fixed_res.conditional_volatility], axis=1)

df.columns = ["Estimated", "Fixed"]

subplot = df.plot()

subplot.set_xlim(xlim)

[9]:

(np.float64(10596.0), np.float64(17896.0))

Building a Model From Components¶

Models can also be systematically assembled from the three model components:

A mean model (

arch.mean)Zero mean (

ZeroMean) - useful if using residuals from a model estimated separatelyConstant mean (

ConstantMean) - common for most liquid financial assetsAutoregressive (

ARX) with optional exogenous regressorsHeterogeneous (

HARX) autoregression with optional exogenous regressorsExogenous regressors only (

LS)

A volatility process (

arch.volatility)ARCH (

ARCH)GARCH (

GARCH)GJR-GARCH (

GARCHusingoargument)TARCH/ZARCH (

GARCHusingpowerargument set to1)Power GARCH and Asymmetric Power GARCH (

GARCHusingpower)Exponentially Weighted Moving Average Variance with estimated coefficient (

EWMAVariance)Heterogeneous ARCH (

HARCH)Parameterless Models

Exponentially Weighted Moving Average Variance, known as RiskMetrics (

EWMAVariance)Weighted averages of EWMAs, known as the RiskMetrics 2006 methodology (

RiskMetrics2006)

A distribution (

arch.distribution)Normal (

Normal)Standardized Students’s T (

StudentsT)

Mean Models¶

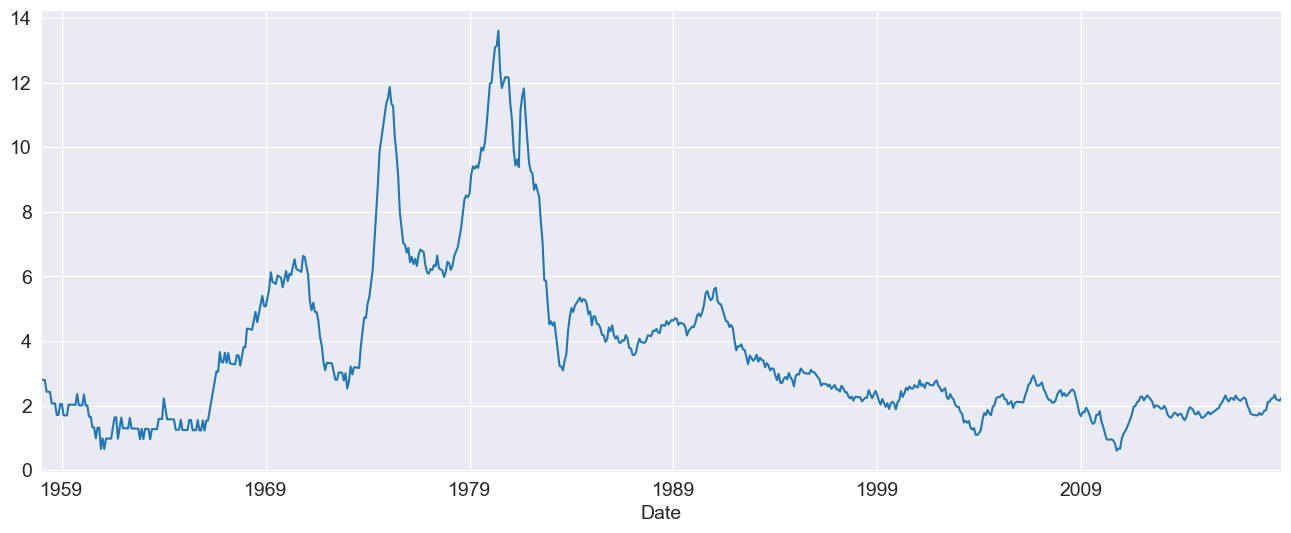

The first choice is the mean model. For many liquid financial assets, a constant mean (or even zero) is adequate. For other series, such as inflation, a more complicated model may be required. These examples make use of Core CPI downloaded from the Federal Reserve Economic Data site.

[10]:

import arch.data.core_cpi

core_cpi = arch.data.core_cpi.load()

ann_inflation = 100 * core_cpi.CPILFESL.pct_change(12).dropna()

fig = ann_inflation.plot()

All mean models are initialized with constant variance and normal errors. For ARX models, the lags argument specifies the lags to include in the model.

[11]:

from arch.univariate import ARX

ar = ARX(100 * ann_inflation, lags=[1, 3, 12])

print(ar.fit().summary())

AR - Constant Variance Model Results

==============================================================================

Dep. Variable: CPILFESL R-squared: 0.991

Mean Model: AR Adj. R-squared: 0.991

Vol Model: Constant Variance Log-Likelihood: -3299.84

Distribution: Normal AIC: 6609.68

Method: Maximum Likelihood BIC: 6632.57

No. Observations: 719

Date: Mon, Mar 09 2026 Df Residuals: 715

Time: 13:00:55 Df Model: 4

Mean Model

===============================================================================

coef std err t P>|t| 95.0% Conf. Int.

-------------------------------------------------------------------------------

Const 4.0216 2.030 1.981 4.762e-02 [4.218e-02, 8.001]

CPILFESL[1] 1.1921 3.475e-02 34.306 6.315e-258 [ 1.124, 1.260]

CPILFESL[3] -0.1798 4.076e-02 -4.411 1.030e-05 [ -0.260,-9.989e-02]

CPILFESL[12] -0.0232 1.370e-02 -1.692 9.058e-02 [-5.002e-02,3.666e-03]

Volatility Model

============================================================================

coef std err t P>|t| 95.0% Conf. Int.

----------------------------------------------------------------------------

sigma2 567.4180 64.487 8.799 1.381e-18 [4.410e+02,6.938e+02]

============================================================================

Covariance estimator: White's Heteroskedasticity Consistent Estimator

Volatility Processes¶

Volatility processes can be added to a mean model using the volatility property. This example adds an ARCH(5) process to model volatility. The arguments iter and disp are used in fit() to suppress estimation output.

[12]:

from arch.univariate import ARCH, GARCH

ar.volatility = ARCH(p=5)

res = ar.fit(update_freq=0, disp="off")

print(res.summary())

AR - ARCH Model Results

==============================================================================

Dep. Variable: CPILFESL R-squared: 0.991

Mean Model: AR Adj. R-squared: 0.991

Vol Model: ARCH Log-Likelihood: -3174.60

Distribution: Normal AIC: 6369.19

Method: Maximum Likelihood BIC: 6414.97

No. Observations: 719

Date: Mon, Mar 09 2026 Df Residuals: 715

Time: 13:00:55 Df Model: 4

Mean Model

===============================================================================

coef std err t P>|t| 95.0% Conf. Int.

-------------------------------------------------------------------------------

Const 2.8500 1.883 1.513 0.130 [ -0.841, 6.541]

CPILFESL[1] 1.0859 3.534e-02 30.725 2.600e-207 [ 1.017, 1.155]

CPILFESL[3] -0.0788 3.855e-02 -2.045 4.084e-02 [ -0.154,-3.282e-03]

CPILFESL[12] -0.0189 1.157e-02 -1.630 0.103 [-4.154e-02,3.821e-03]

Volatility Model

==========================================================================

coef std err t P>|t| 95.0% Conf. Int.

--------------------------------------------------------------------------

omega 76.8691 16.016 4.799 1.592e-06 [ 45.477,1.083e+02]

alpha[1] 0.1344 4.003e-02 3.359 7.827e-04 [5.599e-02, 0.213]

alpha[2] 0.2280 6.284e-02 3.628 2.861e-04 [ 0.105, 0.351]

alpha[3] 0.1838 6.801e-02 2.702 6.894e-03 [5.046e-02, 0.317]

alpha[4] 0.2538 7.826e-02 3.242 1.185e-03 [ 0.100, 0.407]

alpha[5] 0.1954 7.092e-02 2.756 5.856e-03 [5.643e-02, 0.334]

==========================================================================

Covariance estimator: robust

Plotting the standardized residuals and the conditional volatility shows some large (in magnitude) errors, even when standardized.

[13]:

fig = res.plot()

Distributions¶

Finally the distribution can be changed from the default normal to a standardized Student’s T using the distribution property of a mean model.

The Student’s t distribution improves the model, and the degree of freedom is estimated to be near 8.

[14]:

from arch.univariate import StudentsT

ar.distribution = StudentsT()

res = ar.fit(update_freq=0, disp="off")

print(res.summary())

AR - ARCH Model Results

====================================================================================

Dep. Variable: CPILFESL R-squared: 0.991

Mean Model: AR Adj. R-squared: 0.991

Vol Model: ARCH Log-Likelihood: -3168.25

Distribution: Standardized Student's t AIC: 6358.51

Method: Maximum Likelihood BIC: 6408.86

No. Observations: 719

Date: Mon, Mar 09 2026 Df Residuals: 715

Time: 13:00:56 Df Model: 4

Mean Model

===============================================================================

coef std err t P>|t| 95.0% Conf. Int.

-------------------------------------------------------------------------------

Const 3.1221 1.861 1.678 9.341e-02 [ -0.525, 6.770]

CPILFESL[1] 1.0843 3.525e-02 30.763 8.280e-208 [ 1.015, 1.153]

CPILFESL[3] -0.0730 3.873e-02 -1.885 5.946e-02 [ -0.149,2.912e-03]

CPILFESL[12] -0.0236 1.316e-02 -1.791 7.331e-02 [-4.935e-02,2.224e-03]

Volatility Model

==========================================================================

coef std err t P>|t| 95.0% Conf. Int.

--------------------------------------------------------------------------

omega 87.3495 20.624 4.235 2.282e-05 [ 46.927,1.278e+02]

alpha[1] 0.1715 5.064e-02 3.386 7.085e-04 [7.222e-02, 0.271]

alpha[2] 0.2202 6.394e-02 3.444 5.742e-04 [9.485e-02, 0.345]

alpha[3] 0.1547 6.327e-02 2.446 1.446e-02 [3.072e-02, 0.279]

alpha[4] 0.2117 7.287e-02 2.905 3.677e-03 [6.884e-02, 0.354]

alpha[5] 0.1959 7.853e-02 2.495 1.261e-02 [4.199e-02, 0.350]

Distribution

========================================================================

coef std err t P>|t| 95.0% Conf. Int.

------------------------------------------------------------------------

nu 9.0448 3.365 2.688 7.193e-03 [ 2.449, 15.640]

========================================================================

Covariance estimator: robust

WTI Crude¶

The next example uses West Texas Intermediate Crude data from FRED. Three models are fit using alternative distributional assumptions. The results are printed, where we can see that the normal has a much lower log-likelihood than either the Standard Student’s T or the Standardized Skew Student’s T – however, these two are fairly close. The closeness of the T and the Skew T indicate that returns are not heavily skewed.

[15]:

from collections import OrderedDict

import arch.data.wti

crude = arch.data.wti.load()

crude_ret = 100 * crude.DCOILWTICO.dropna().pct_change().dropna()

res_normal = arch_model(crude_ret).fit(disp="off")

res_t = arch_model(crude_ret, dist="t").fit(disp="off")

res_skewt = arch_model(crude_ret, dist="skewt").fit(disp="off")

lls = pd.Series(

OrderedDict(

(

("normal", res_normal.loglikelihood),

("t", res_t.loglikelihood),

("skewt", res_skewt.loglikelihood),

)

)

)

print(lls)

params = pd.DataFrame(

OrderedDict(

(

("normal", res_normal.params),

("t", res_t.params),

("skewt", res_skewt.params),

)

)

)

params

normal -18165.858870

t -17919.643916

skewt -17916.669052

dtype: float64

[15]:

| normal | t | skewt | |

|---|---|---|---|

| alpha[1] | 0.085627 | 0.064980 | 0.064889 |

| beta[1] | 0.909098 | 0.927950 | 0.928215 |

| eta | NaN | NaN | 6.186637 |

| lambda | NaN | NaN | -0.036986 |

| mu | 0.046682 | 0.056438 | 0.040928 |

| nu | NaN | 6.178655 | NaN |

| omega | 0.055806 | 0.048516 | 0.047682 |

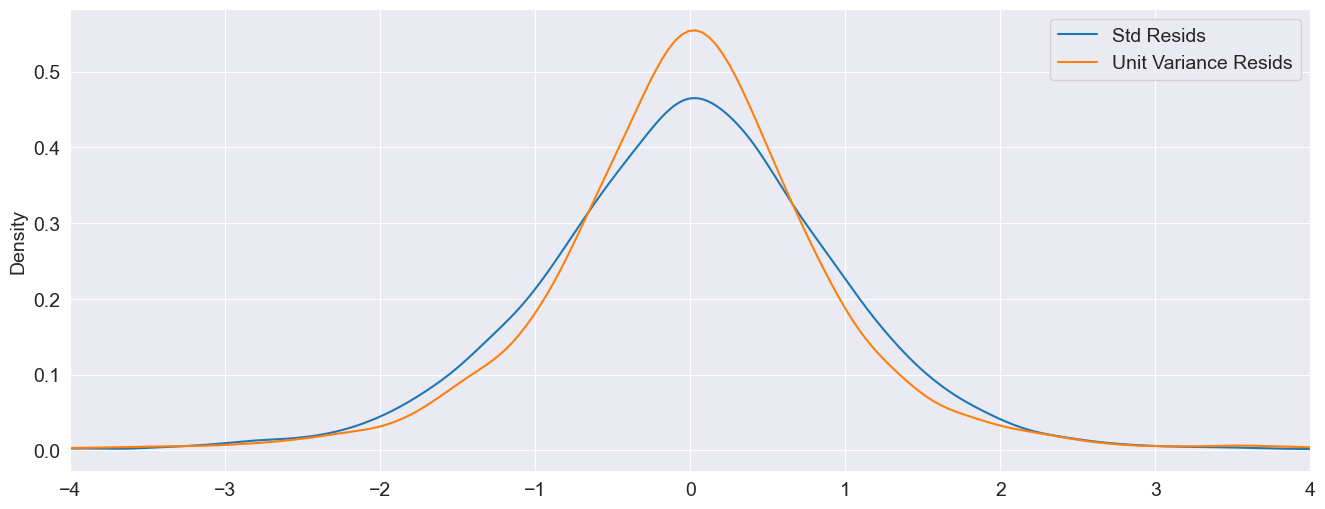

The standardized residuals can be computed by dividing the residuals by the conditional volatility. These are plotted along with the (unstandardized, but scaled) residuals. The non-standardized residuals are more peaked in the center indicating that the distribution is somewhat more heavy tailed than that of the standardized residuals.

[16]:

std_resid = res_normal.resid / res_normal.conditional_volatility

unit_var_resid = res_normal.resid / res_normal.resid.std()

df = pd.concat([std_resid, unit_var_resid], axis=1)

df.columns = ["Std Resids", "Unit Variance Resids"]

subplot = df.plot(kind="kde", xlim=(-4, 4))

Simulation¶

All mean models expose a method to simulate returns from assuming the model is correctly specified. There are two required parameters, params which are the model parameters, and nobs, the number of observations to produce.

Below we simulate from a GJR-GARCH(1,1) with Skew-t errors using parameters estimated on the WTI series. The simulation returns a DataFrame with 3 columns:

data: The simulated data, which includes any mean dynamics.volatility: The conditional volatility serieserrors: The simulated errors generated to produce the model. The errors are the difference between the data and its conditional mean, and can be transformed into the standardized errors by dividing by the volatility.

[17]:

res = arch_model(crude_ret, p=1, o=1, q=1, dist="skewt").fit(disp="off")

pd.DataFrame(res.params)

[17]:

| params | |

|---|---|

| mu | 0.029365 |

| omega | 0.044375 |

| alpha[1] | 0.044344 |

| gamma[1] | 0.036104 |

| beta[1] | 0.931280 |

| eta | 6.211263 |

| lambda | -0.041615 |

[18]:

sim_mod = arch_model(None, p=1, o=1, q=1, dist="skewt")

sim_data = sim_mod.simulate(res.params, 1000)

sim_data.head()

[18]:

| data | volatility | errors | |

|---|---|---|---|

| 0 | -1.508989 | 3.016869 | -1.538354 |

| 1 | -3.246835 | 2.951406 | -3.276200 |

| 2 | -0.942701 | 3.003341 | -0.972067 |

| 3 | 2.311109 | 2.919004 | 2.281744 |

| 4 | 0.697290 | 2.865361 | 0.667925 |

Simulations can be reproduced using a NumPy RandomState. This requires constructing a model from components where the RandomState instance is passed into to the distribution when the model is created.

The cell below contains code that builds a model with a constant mean, GJR-GARCH volatility and Skew \(t\) errors initialized with a user-provided RandomState. Saving the initial state allows it to be restored later so that the simulation can be run with the same random values.

[19]:

import numpy as np

from arch.univariate import ConstantMean, SkewStudent

rs = np.random.RandomState([892380934, 189201902, 129129894, 9890437])

# Save the initial state to reset later

state = rs.get_state()

dist = SkewStudent(seed=rs)

vol = GARCH(p=1, o=1, q=1)

repro_mod = ConstantMean(None, volatility=vol, distribution=dist)

repro_mod.simulate(res.params, 1000).head()

[19]:

| data | volatility | errors | |

|---|---|---|---|

| 0 | 1.616842 | 4.787720 | 1.587477 |

| 1 | 4.106797 | 4.637150 | 4.077432 |

| 2 | 4.530217 | 4.561477 | 4.500852 |

| 3 | 2.284841 | 4.507758 | 2.255476 |

| 4 | 3.378530 | 4.381033 | 3.349165 |

Resetting the state using set_state shows that calling simulate using the same underlying state in the RandomState produces the same objects.

[20]:

# Reset the state to the initial state

rs.set_state(state)

repro_mod.simulate(res.params, 1000).head()

[20]:

| data | volatility | errors | |

|---|---|---|---|

| 0 | 1.616842 | 4.787720 | 1.587477 |

| 1 | 4.106797 | 4.637150 | 4.077432 |

| 2 | 4.530217 | 4.561477 | 4.500852 |

| 3 | 2.284841 | 4.507758 | 2.255476 |

| 4 | 3.378530 | 4.381033 | 3.349165 |