Volatility Forecasting¶

This setup code is required to run in an IPython notebook

[1]:

import matplotlib.pyplot as plt

import seaborn as sns

sns.set_style("darkgrid")

plt.rc("figure", figsize=(16, 6))

plt.rc("savefig", dpi=90)

plt.rc("font", family="sans-serif")

plt.rc("font", size=14)

Data¶

These examples make use of S&P 500 data from Yahoo! that is available from arch.data.sp500.

[2]:

import sys

import arch.data.sp500

import numpy as np

import pandas as pd

from arch import arch_model

data = arch.data.sp500.load()

market = data["Adj Close"]

returns = 100 * market.pct_change().dropna()

Basic Forecasting¶

Forecasts can be generated for standard GARCH(p,q) processes using any of the three forecast generation methods:

Analytical

Simulation-based

Bootstrap-based

Be default forecasts will only be produced for the final observation in the sample so that they are out-of-sample.

Forecasts start with specifying the model and estimating parameters.

[3]:

am = arch_model(returns, vol="Garch", p=1, o=0, q=1, dist="Normal")

res = am.fit(update_freq=5)

Iteration: 5, Func. Count: 35, Neg. LLF: 6970.284960008103

Iteration: 10, Func. Count: 63, Neg. LLF: 6936.718477484757

Optimization terminated successfully (Exit mode 0)

Current function value: 6936.718476988985

Iterations: 11

Function evaluations: 68

Gradient evaluations: 11

[4]:

forecasts = res.forecast()

Forecasts are contained in an ARCHModelForecast object which has 4 attributes:

mean- The forecast meansresidual_variance- The forecast residual variances, that is \(E_t[\epsilon_{t+h}^2]\)variance- The forecast variance of the process, \(E_t[r_{t+h}^2]\). The variance will differ from the residual variance whenever the model has mean dynamics, e.g., in an AR process.simulations- An object that contains detailed information about the simulations used to generate forecasts. Only used if the forecastmethodis set to'simulation'or'bootstrap'. If using'analytical'(the default), this isNone.

The three main outputs are all returned in DataFrames with columns of the form h.# where # is the number of steps ahead. That is, h.1 corresponds to one-step ahead forecasts while h.10 corresponds to 10-steps ahead.

The default forecast only produces 1-step ahead forecasts.

[5]:

print(forecasts.mean.iloc[-3:])

print(forecasts.residual_variance.iloc[-3:])

print(forecasts.variance.iloc[-3:])

h.1

Date

2018-12-31 0.056353

h.1

Date

2018-12-31 3.59647

h.1

Date

2018-12-31 3.59647

Longer horizon forecasts can be computed by passing the parameter horizon.

[6]:

forecasts = res.forecast(horizon=5)

print(forecasts.residual_variance.iloc[-3:])

h.1 h.2 h.3 h.4 h.5

Date

2018-12-31 3.59647 3.568502 3.540887 3.513621 3.4867

Alternative Forecast Generation Schemes¶

Fixed Window Forecasting¶

Fixed-windows forecasting uses data up to a specified date to generate all forecasts after that date. This can be implemented by passing the entire data in when initializing the model and then using last_obs when calling fit. forecast() will, by default, produce forecasts after this final date.

Note last_obs follow Python sequence rules so that the actual date in last_obs is not in the sample.

[7]:

res = am.fit(last_obs="2011-1-1", update_freq=5)

forecasts = res.forecast(horizon=5)

print(forecasts.variance.dropna().head())

Iteration: 5, Func. Count: 34, Neg. LLF: 4578.713300777299

Iteration: 10, Func. Count: 63, Neg. LLF: 4555.338450947712

Optimization terminated successfully (Exit mode 0)

Current function value: 4555.285110045383

Iterations: 14

Function evaluations: 83

Gradient evaluations: 14

h.1 h.2 h.3 h.4 h.5

Date

2010-12-31 0.381757 0.390905 0.399988 0.409008 0.417964

2011-01-03 0.451724 0.460381 0.468976 0.477512 0.485987

2011-01-04 0.428416 0.437236 0.445994 0.454691 0.463326

2011-01-05 0.420554 0.429429 0.438242 0.446993 0.455683

2011-01-06 0.402483 0.411486 0.420425 0.429301 0.438115

Rolling Window Forecasting¶

Rolling window forecasts use a fixed sample length and then produce one-step from the final observation. These can be implemented using first_obs and last_obs.

[8]:

index = returns.index

start_loc = 0

end_loc = np.where(index >= "2010-1-1")[0].min()

forecasts = {}

for i in range(20):

sys.stdout.write(".")

sys.stdout.flush()

res = am.fit(first_obs=i, last_obs=i + end_loc, disp="off")

temp = res.forecast(horizon=3).variance

fcast = temp.iloc[0]

forecasts[fcast.name] = fcast

print()

print(pd.DataFrame(forecasts).T)

....................

h.1 h.2 h.3

2009-12-31 0.615314 0.621743 0.628133

2010-01-04 0.751747 0.757343 0.762905

2010-01-05 0.710453 0.716315 0.722142

2010-01-06 0.666244 0.672346 0.678411

2010-01-07 0.634424 0.640706 0.646949

2010-01-08 0.600109 0.606595 0.613040

2010-01-11 0.565514 0.572212 0.578869

2010-01-12 0.599560 0.606051 0.612501

2010-01-13 0.608309 0.614748 0.621148

2010-01-14 0.575065 0.581756 0.588406

2010-01-15 0.629890 0.636245 0.642561

2010-01-19 0.695074 0.701042 0.706974

2010-01-20 0.737154 0.742908 0.748627

2010-01-21 0.954167 0.958725 0.963255

2010-01-22 1.253453 1.256401 1.259332

2010-01-25 1.178691 1.182043 1.185374

2010-01-26 1.112205 1.115886 1.119545

2010-01-27 1.051295 1.055327 1.059335

2010-01-28 1.085678 1.089512 1.093324

2010-01-29 1.085786 1.089594 1.093378

Recursive Forecast Generation¶

Recursive is similar to rolling except that the initial observation does not change. This can be easily implemented by dropping the first_obs input.

[9]:

import numpy as np

import pandas as pd

index = returns.index

start_loc = 0

end_loc = np.where(index >= "2010-1-1")[0].min()

forecasts = {}

for i in range(20):

sys.stdout.write(".")

sys.stdout.flush()

res = am.fit(last_obs=i + end_loc, disp="off")

temp = res.forecast(horizon=3).variance

fcast = temp.iloc[0]

forecasts[fcast.name] = fcast

print()

print(pd.DataFrame(forecasts).T)

....................

h.1 h.2 h.3

2009-12-31 0.615314 0.621743 0.628133

2010-01-04 0.751723 0.757321 0.762885

2010-01-05 0.709956 0.715791 0.721591

2010-01-06 0.666057 0.672146 0.678197

2010-01-07 0.634503 0.640776 0.647011

2010-01-08 0.600417 0.606893 0.613329

2010-01-11 0.565684 0.572369 0.579014

2010-01-12 0.599963 0.606438 0.612874

2010-01-13 0.608558 0.614982 0.621366

2010-01-14 0.575020 0.581639 0.588217

2010-01-15 0.629696 0.635989 0.642244

2010-01-19 0.694735 0.700656 0.706541

2010-01-20 0.736509 0.742193 0.747842

2010-01-21 0.952751 0.957245 0.961713

2010-01-22 1.251145 1.254050 1.256936

2010-01-25 1.176864 1.180162 1.183441

2010-01-26 1.110848 1.114497 1.118124

2010-01-27 1.050102 1.054077 1.058028

2010-01-28 1.084669 1.088454 1.092216

2010-01-29 1.085003 1.088783 1.092541

TARCH¶

Analytical Forecasts¶

All ARCH-type models have one-step analytical forecasts. Longer horizons only have closed forms for specific models. TARCH models do not have closed-form (analytical) forecasts for horizons larger than 1, and so simulation or bootstrapping is required. Attempting to produce forecasts for horizons larger than 1 using method='analytical' results in a ValueError.

[10]:

# TARCH specification

am = arch_model(returns, vol="GARCH", power=2.0, p=1, o=1, q=1)

res = am.fit(update_freq=5)

forecasts = res.forecast()

print(forecasts.variance.iloc[-1])

Iteration: 5, Func. Count: 40, Neg. LLF: 6846.495527491306

Iteration: 10, Func. Count: 75, Neg. LLF: 6822.88318030922

Optimization terminated successfully (Exit mode 0)

Current function value: 6822.882823373991

Iterations: 13

Function evaluations: 93

Gradient evaluations: 13

h.1 3.010188

Name: 2018-12-31 00:00:00, dtype: float64

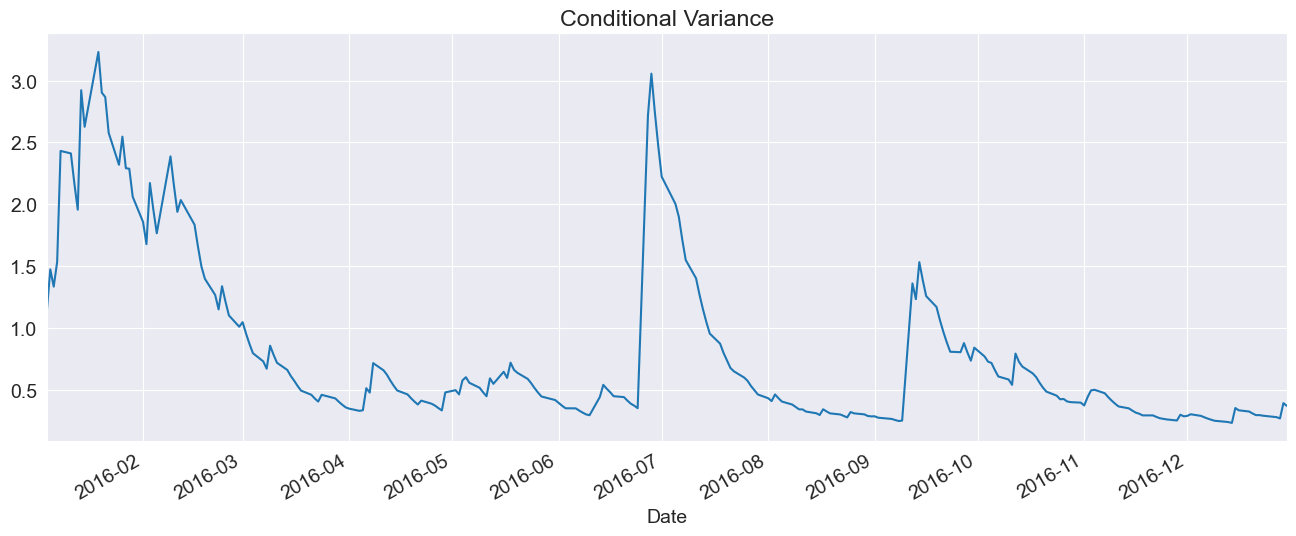

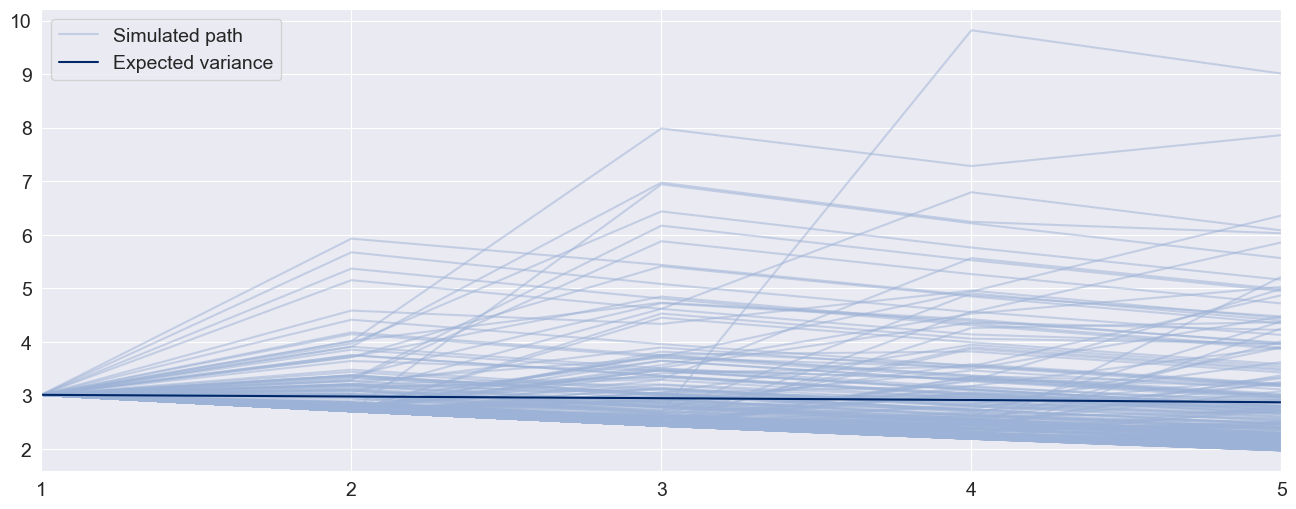

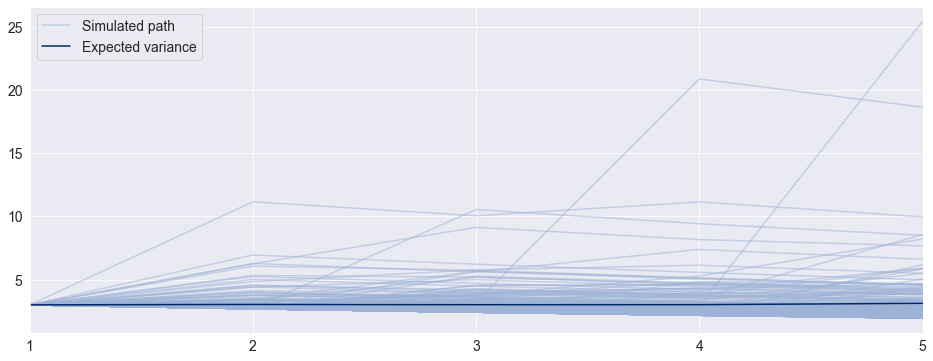

Simulation Forecasts¶

When using simulation- or bootstrap-based forecasts, an additional attribute of an ARCHModelForecast object is meaningful – simulation.

[11]:

import matplotlib.pyplot as plt

fig, ax = plt.subplots(1, 1)

var_2016 = res.conditional_volatility["2016"] ** 2.0

subplot = var_2016.plot(ax=ax, title="Conditional Variance")

subplot.set_xlim(var_2016.index[0], var_2016.index[-1])

[11]:

(np.float64(16804.0), np.float64(17165.0))

[12]:

forecasts = res.forecast(horizon=5, method="simulation")

sims = forecasts.simulations

x = np.arange(1, 6)

lines = plt.plot(x, sims.residual_variances[-1, ::5].T, color="#9cb2d6", alpha=0.5)

lines[0].set_label("Simulated path")

line = plt.plot(x, forecasts.variance.iloc[-1].values, color="#002868")

line[0].set_label("Expected variance")

plt.gca().set_xticks(x)

plt.gca().set_xlim(1, 5)

legend = plt.legend()

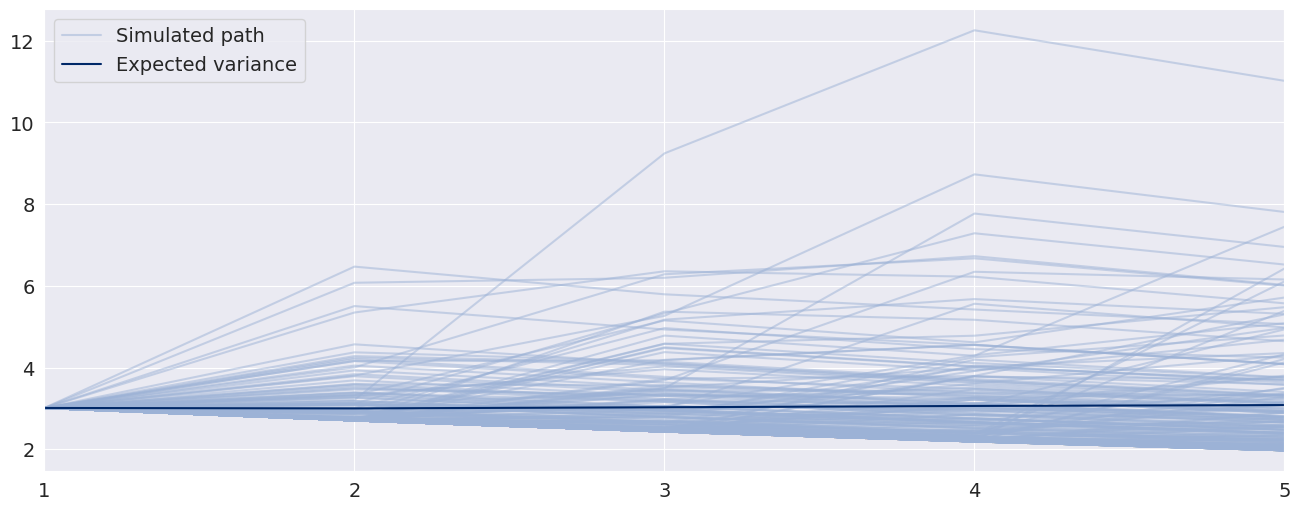

Bootstrap Forecasts¶

Bootstrap-based forecasts are nearly identical to simulation-based forecasts except that the values used to simulate the process are computed from historical data rather than using the assumed distribution of the residuals. Forecasts produced using this method also return an ARCHModelForecastSimulation containing information about the simulated paths.

[13]:

forecasts = res.forecast(horizon=5, method="bootstrap")

sims = forecasts.simulations

lines = plt.plot(x, sims.residual_variances[-1, ::5].T, color="#9cb2d6", alpha=0.5)

lines[0].set_label("Simulated path")

line = plt.plot(x, forecasts.variance.iloc[-1].values, color="#002868")

line[0].set_label("Expected variance")

plt.gca().set_xticks(x)

plt.gca().set_xlim(1, 5)

legend = plt.legend()

Value-at-Risk Forecasting¶

Value-at-Risk (VaR) forecasts from GARCH models depend on the conditional mean, the conditional volatility and the quantile of the standardized residuals,

where \(q_{\alpha}\) is the \(\alpha\) quantile of the standardized residuals, e.g., 5%.

The quantile can be either computed from the estimated model density or computed using the empirical distribution of the standardized residuals. The example below shows both methods.

[14]:

am = arch_model(returns, vol="Garch", p=1, o=0, q=1, dist="skewt")

res = am.fit(disp="off", last_obs="2017-12-31")

Parametric VaR¶

First, we use the model to estimate the VaR. The quantiles can be computed using the ppf method of the distribution attached to the model. The quantiles are printed below.

Note: forecast is called with align="target" so that the forecasts are already aligned with the target and so do not need further shifting.

[15]:

forecasts = res.forecast(align="target")

cond_mean = forecasts.mean["2018":].dropna()

cond_var = forecasts.variance["2018":].dropna()

q = am.distribution.ppf([0.01, 0.05], res.params[-2:])

print(q)

[-2.64487243 -1.64965756]

Next, we plot the two VaRs along with the returns. The returns that violate the VaR forecasts are highlighted.

[16]:

value_at_risk = -cond_mean.values - np.sqrt(cond_var).values * q[None, :]

value_at_risk = pd.DataFrame(value_at_risk, columns=["1%", "5%"], index=cond_var.index)

ax = value_at_risk.plot(legend=False)

xl = ax.set_xlim(value_at_risk.index[0], value_at_risk.index[-1])

rets_2018 = returns["2018":].copy()

rets_2018.name = "S&P 500 Return"

c = []

for idx in value_at_risk.index:

if rets_2018[idx] > -value_at_risk.loc[idx, "5%"]:

c.append("#000000")

elif rets_2018[idx] < -value_at_risk.loc[idx, "1%"]:

c.append("#BB0000")

else:

c.append("#BB00BB")

c = np.array(c, dtype="object")

labels = {

"#BB0000": "1% Exceedence",

"#BB00BB": "5% Exceedence",

"#000000": "No Exceedence",

}

markers = {"#BB0000": "x", "#BB00BB": "s", "#000000": "o"}

for color in np.unique(c):

sel = c == color

ax.scatter(

rets_2018.index[sel],

-rets_2018.loc[sel],

marker=markers[color],

c=c[sel],

label=labels[color],

)

ax.set_title("Parametric VaR")

leg = ax.legend(frameon=False, ncol=3)

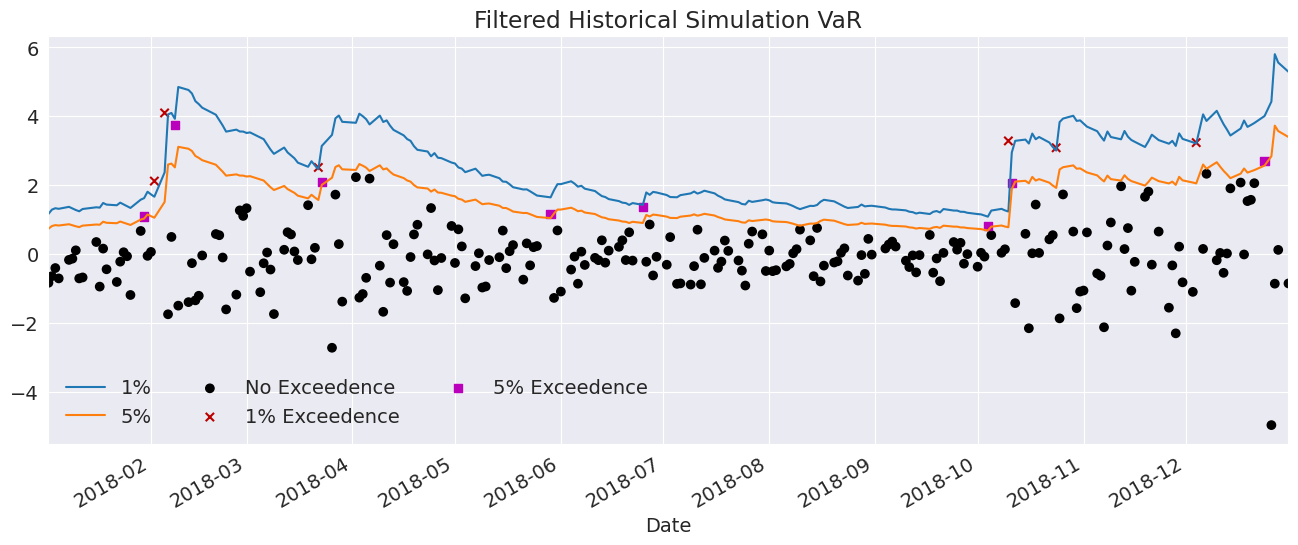

Filtered Historical Simulation¶

Next, we use the empirical distribution of the standardized residuals to estimate the quantiles. These values are very similar to those estimated using the assumed distribution. The plot below is identical except for the slightly different quantiles.

[17]:

std_rets = (returns[:"2017"] - res.params["mu"]) / res.conditional_volatility

std_rets = std_rets.dropna()

q = std_rets.quantile([0.01, 0.05])

print(q)

0.01 -2.668265

0.05 -1.723341

dtype: float64

[18]:

value_at_risk = -cond_mean.values - np.sqrt(cond_var).values * q.values[None, :]

value_at_risk = pd.DataFrame(value_at_risk, columns=["1%", "5%"], index=cond_var.index)

ax = value_at_risk.plot(legend=False)

xl = ax.set_xlim(value_at_risk.index[0], value_at_risk.index[-1])

rets_2018 = returns["2018":].copy()

rets_2018.name = "S&P 500 Return"

c = []

for idx in value_at_risk.index:

if rets_2018[idx] > -value_at_risk.loc[idx, "5%"]:

c.append("#000000")

elif rets_2018[idx] < -value_at_risk.loc[idx, "1%"]:

c.append("#BB0000")

else:

c.append("#BB00BB")

c = np.array(c, dtype="object")

for color in np.unique(c):

sel = c == color

ax.scatter(

rets_2018.index[sel],

-rets_2018.loc[sel],

marker=markers[color],

c=c[sel],

label=labels[color],

)

ax.set_title("Filtered Historical Simulation VaR")

leg = ax.legend(frameon=False, ncol=3)